INDICATING PROMISING SIGNS

The Indian economic outlook for October 2023 reflects a mix of positive and challenging indicators.

The Purchasing Managers’ Index (PMI) for manufacturing, although slightly lower at 57.5 in September, continues to indicate expansion, remaining well above the benchmark of 50. PMI services surged to 61 in September, marking one of its highest levels in over 13 years, indicating robust growth in the services sector. Industrial production (IIP) showed promising signs, accelerating to a 14-month high of 10.3 percent in August 2023, reflecting enhanced manufacturing and production activity.

On the monetary front, the Reserve Bank of India’s Monetary Policy Committee retained the repo rate at 6.5 percent in its October 2023 review, signaling a continued focus on maintaining stability in the financial markets. Inflationary pressures have eased with CPI inflation falling to 5.0 percent in September.

The fiscal picture showed a mixed performance, with the Government’s gross tax revenues (GTR) for April-August FY24 growing by 16.5 percent, reflecting robust direct tax growth. India’s merchandise trade balance remained a concern as both exports and imports contracted for the tenth successive month in September. The current account deficit increased to 1.1 percent of GDP in Q1FY24 due to a higher merchandise trade deficit.

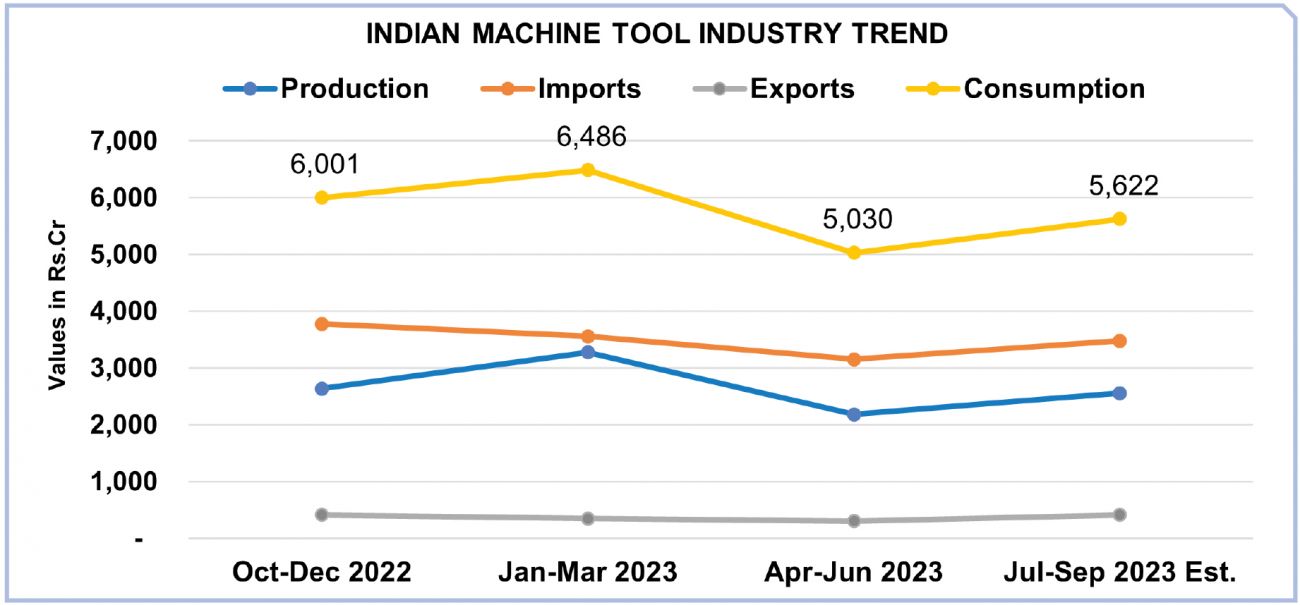

| The Machine Tool industry production and orders booked in Q1FY24 remained impressive despite the flat growth in exports. The Indian machine tool market continues to expand, with consumption reaching `10,651 Crore (US$1.3 B) at 7 percent Y/Y growth in H1FY24 |

Promising despite challenges

Meanwhile, net foreign direct investments (FDIs) turned negative, with outflows exceeding inflows in August. Despite these challenges, India’s economic growth remains promising, with the OECD and IMF forecasting global growth at 3 percent in 2023 and India’s FY24 growth projected at 6.3 percent, indicating the potential for an economic rebound in the coming year.

On the machine tool front, production for the July to September quarter of 2023 (Q2FY24) increased by an estimated 12 percent year-on-year (Y/Y), reaching `2,558 Crore (US$ 309 M). Orders booked during the same period witnessed an impressive growth of an estimated 18 percent Y/Y, totaling `3,742 Crore (US$ 453 M). The industry’s imports in Q2FY24 saw a rise of 7 percent year-on-year, amounting to `3,476 Crore (US$ 420 M). Machine tool exports from India reported a flat 1 percent growth, amounting to `413 Crore (US$50 M) and consumption is estimated to have increased by 10 percent to reach `5,622 Crore (US$ 680 M) in Q2FY24.

China, Japan, and Germany emerged as the top countries exporting to India, contributing 58 percent of the total machine tool imports in April to September 2023 (H1FY24). Lathes, Presses, and Vertical Machining Centers (VMCs) were the top machinery imported valued at `2,303 Crore (US$ 279 M) at about 35 percent of total machine tool imports in H1FY24.

As for exports, Russia, China, and the USA emerged as the top three export destinations, accounting for 44 percent of total machine tool exports in H1FY24. Lathes, Horizontal, and Vertical Machining Centers were the top three machinery exported valued at `269 Crore (US$ 33 M) at about 38 percent of total machine tool exports in H1FY24.

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe