STAYING RESILIENT

Key economic indicators collectively suggest a relatively stable outlook for India’s economic landscape in 2023. Read on to explore specific figures for machine tools export, import, and production.

In December 2023, India experienced a robust economic growth. The real GDP demonstrated a strong performance, growing by 7.6 percent in the second quarter and 7.7 percent in the first half of fiscal year 2023-24, primarily driven by a surge in investment demand. Manufacturing and services PMI maintained high levels of 56 and 56.9 in November 2023, underlining the resilience of the sectors.

On the inflation front, CPI inflation rose to 5.6 percent in November due to higher vegetable prices, while core CPI inflation eased to 4.1 percent. WPI inflation turned positive at 0.3 percent, breaking a seven-month contraction, primarily fuelled by increased vegetable prices. The Monetary Policy Committee (MPC) chose to retain the repo rate at 6.5 percent in its December 2023 review.

During April-October FY2024, Government finances exhibited positive trends, with gross tax revenues growing by 14 percent, led by direct taxes at 24.1 percent. Total expenditure during the same period increased by 11.7 percent, with capital expenditure rising significantly by 33.7 percent. However, fiscal and revenue deficits, as proportions of their annual Budget Estimates, stood at 45 percent and 32.2 percent, respectively.

|

For exports, Russia (29%), China (9%), and the USA (9%) emerged as the top three export destinations, accounting for 47 percent of total machine tool exports from April to November 2023, with a total export value of `1,005 crore (US $121 M) and 4,515 units of machines exported. |

The merchandise trade deficit narrowed to US $20.6 billion from an unprecedented high in October. Net FDI inflows surged to US $5.9 billion in October, and the average global crude price moderated to US $81.4/bbl. The OECD projected global growth at 2.9 percent in 2023, with India’s FY24 growth forecasted at 6.3 percent. These key economic indicators collectively suggest a relatively stable outlook for India’s economic landscape in 2023.

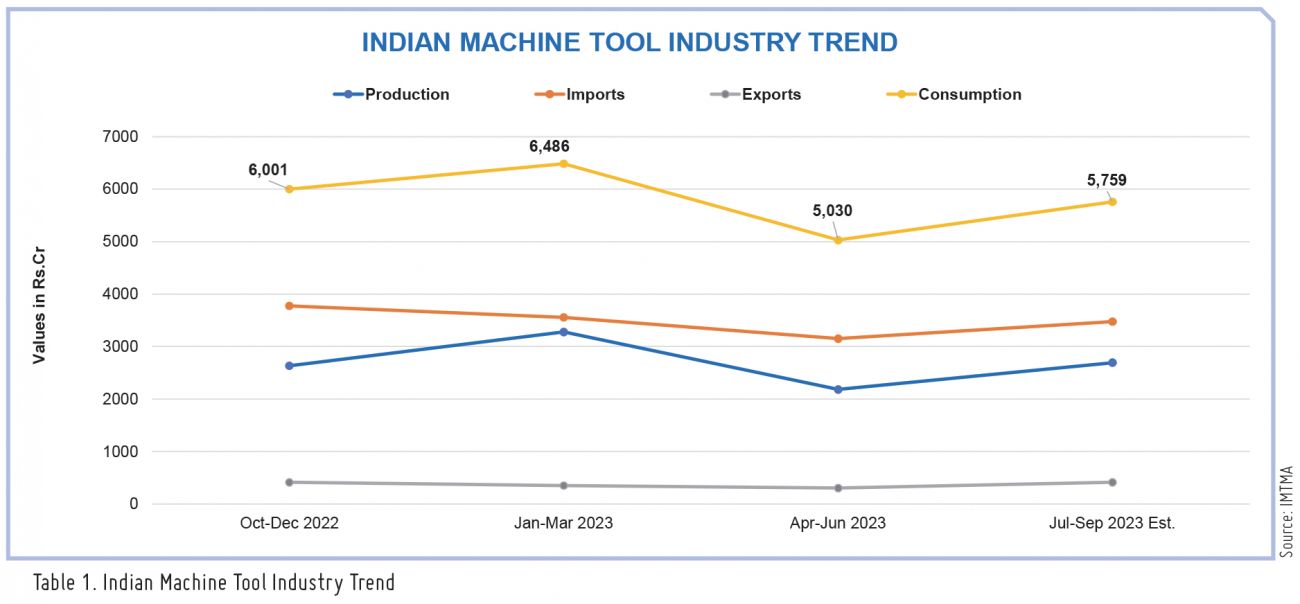

Production for the April to September quarter of 2023 (H1FY24) increased by 14 percent year-on-year, reaching `4,877 crore (US$ 592 M). Orders booked during the same period witnessed an impressive growth of 15 percent, totaling `6,887 crore (US$ 835 M). The industry’s imports in H1FY24 saw a rise of 5 percent year-on-year, amounting to `6,628 crore. (US$ 804 M). Machine tool exports during H1FY24 from India reported a flat 2 percent growth, amounting to `716 crore (US $87 M) and consumption is estimated to have increased by 9 percent to reach `10,789 crore (US$ 1,309 M) in H1FY24.

Total machine tool imports reported from April to November 2023 reached `9,362 crore (US $1.13 B), with 30,821 units of machines imported. China (29%), Japan (20%), and Germany (9%) emerged as the top countries for imports, contributing to 58 percent of the total machine tool imports. Presses (12%), Lathes (12%), and Vertical Machining Centers (VMC) (12%) were the top machinery types imported, valued at `3,356 crore (US $406 M), constituting approximately 36 percent of total machine tool imports during the period.

Lathes (17%), VMC (15%), and Horizontal Machining Centers (HMC) (10%) were the top three machinery types exported, valued at `428 crore (US $52 M), constituting approximately 43 percent of total machine tool exports during April to November 2023.

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe