ROBUST ECONOMY, RISING DEMAND

With strong manufacturing and services momentum, low inflation, and heavy government investment, the Indian economy is showing resilience. For the machine tool industry, this leads to double-digit growth, booming exports, and rising domestic demand.

The economic performance indicators for July 2025 reflect a mixed trend. The manufacturing PMI rose to 59.1, a 16-month high, while the services PMI climbed to 60.5, its highest in 11 months. Additionally, the Index of Industrial Production (IIP) growth moderated to 2.0 percent in Q1 FY26 from 4.0 percent in Q4 FY25.

Consumer Price Index (CPI) inflation moderated for the ninth consecutive month, declining from 2.1 percent in June to 1.6 percent in July, the lowest since June 2017. Wholesale Price Index (WPI) inflation also remained in negative territory for the second month in a row. It contracted by -0.6 percent in July 2025, widening from -0.1 percent in June 2025, largely due to continued declines in food prices supported by favorable base effects.

Fiscal and Policy Developments

|

The IMF (July 2025) projected global growth at 3.0% for 2025 and retained India’s FY26 growth forecast at 6.4%, supported by resilient domestic demand and investments. |

GoI’s gross tax revenue rose 4.6 percent in Q1 FY26, with direct taxes contracting by -0.8 percent and indirect taxes growing by 11.5 percent. Expenditure surged 26 percent, led by a 52 percent jump in capital outlay and 20 percent growth in revenue spending. The fiscal deficit reached 17.9 percent of the annual BE, while the revenue deficit stood at 6.4 percent.

Financial Sector Updates

In the Financial sector, bank credit growth improved to 10.4 percent in June 2025 (from 9.9% in May). On the external front, net FDI inflows were negligible at US$ 0.04 B, while net FPI inflows were stronger at US$ 1.55 B. The RBI retained the repo rate at 5.5 percent in its monetary policy review held on August 6, 2025.

Trade Dynamics

India’s merchandise trade revived in July 2025 with exports up 7.3 percent (driven by non-oil goods) and imports rising 8.6 percent (led by crude oil), after declines in June. Global crude prices touched a four-month high of US$ 69.2/bbl, adding pressure on the import bill.

The IMF (July 2025) projected global growth at 3.0 percent for 2025 and retained India’s FY26 growth forecast at 6.4 percent, supported by resilient domestic demand and investments. As per the estimates from the Ministry of Statistics & Programme Implementation, India’s Real GDP has been estimated to grow by 7.8 percent in Q1 of FY 2025-26, compared with 6.5 percent in Q1 FY25.

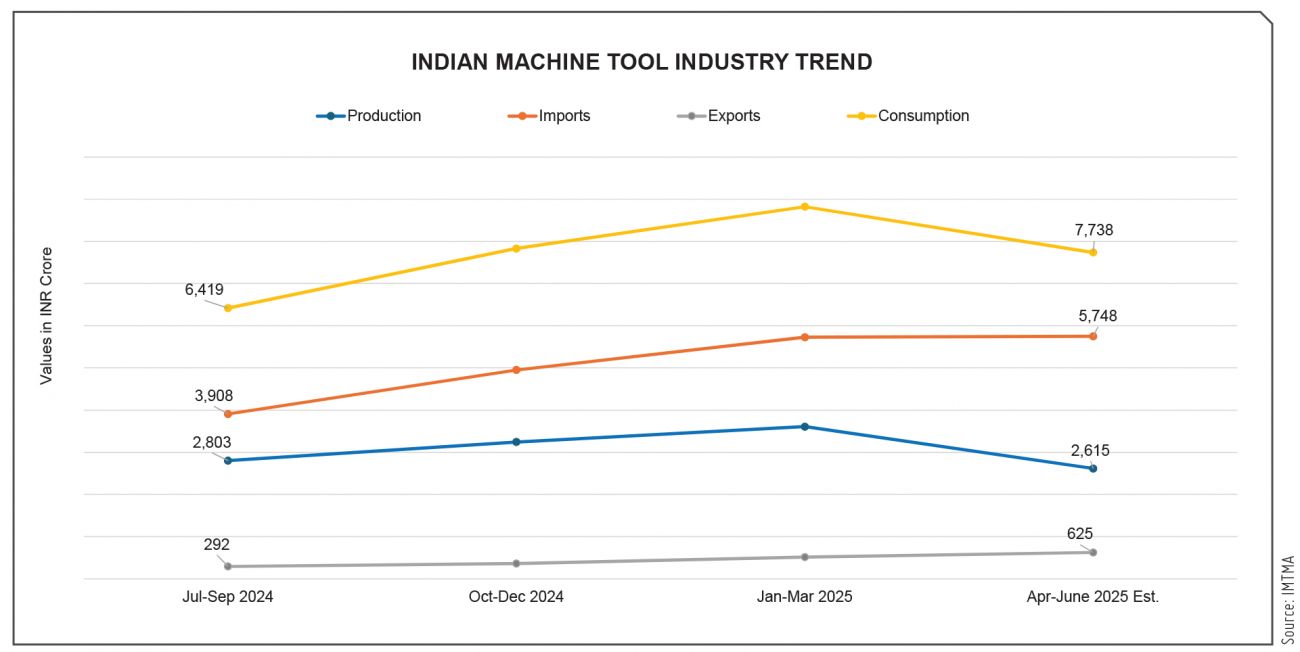

Machine Tool Industry Performance

According to the latest World Machine Tool Survey by Gardner Intelligence, India ranked 4th in consumption and 9th globally in production in 2024. The production of the Indian Machine Tool industry in Q1 FY26 is estimated to have increased by approximately 11 percent year-on-year, reaching around `2,615 crore (US$ 306 M). The industry’s imports in Q1 FY26 saw a rise of 40 percent year-on-year, amounting to `5,748 crore (US$ 672 M). Machine tool exports during Q1 FY26 from India reported a growth of 108 percent, amounting to `625 crore (US$ 73 M) and consumption is estimated to have increased by about 26 percent to reach `7,738 crore (US$ 904 M).

Source: Data & Policy Team, IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe