STRONG GROWTH BOOSTS MACHINE TOOL SECTOR

Supported by continued infrastructure spending and rising industrial demand, India’s economy and manufacturing sector continue to exhibit strong momentum. While domestic machine tool production and exports are slowly improving, the industry faces the challenge of high import dependence.

India’s growth momentum strengthened further in 2QFY26, with real GDP and GVA growth rising to 8.2 percent and 8.1 percent, respectively, from 7.8 percent and 7.6 percent in the previous quarter. High-frequency indicators showed mixed trends, with Manufacturing PMI easing to 56.6 in November 2025, Services PMI remaining strong at 59.8, and IIP growth moderating to a 14-month low of 0.4 percent in October 2025.

Inflation Remains Benign

On the inflation front, CPI inflation remained benign, though it edged up to 0.7 percent in November 2025 from 0.3 percent in October 2025, while core CPI inflation stayed sticky at 4.3 percent during the month. Meanwhile, the pace of contraction in wholesale prices eased to (–)0.3 percent in November 2025 from (–)1.2 percent in October 2025, largely reflecting a moderation in the decline of vegetable and fruit prices.

Government Finances Support Investment-Led Growth

The Government of India’s gross tax revenues grew by 4.0 percent during April–October FY26, driven by a 6.1 percent increase in direct taxes, while indirect taxes rose modestly by 1.7 percent. Total expenditure expanded by 6.1 percent over the same period, with revenue expenditure remaining broadly flat at 0.03 percent and capital expenditure registering a strong growth of 32.4 percent. Consequently, fiscal and revenue deficits during April–October FY26 stood at 52.6 percent and 46.7 percent, respectively, of their annual budget estimates. In the December 2025 monetary policy review, the RBI cut the repo rate by 25 basis points to 5.25 percent from 5.5 percent, while maintaining a neutral policy stance.

External Sector Improves with Narrowing Trade Deficit

In the External sector, the merchandise trade deficit narrowed to a five-month low of US$ 24.5 billion in November 2025 from an unprecedented high of US$ 41.7 billion in October 2025. Merchandise exports rebounded strongly, recording a 41-month high growth of 19.4 percent in November 2025, led by robust expansion in engineering goods exports, while merchandise imports contracted by 1.9 percent, largely due to a sharp decline in gold imports.

|

VMCs (26%), presses (15%), and lathes (10%) were the top three machinery types exported, valued at INR 934 Cr (US$ 107 M), constituting approximately 51% of total machine tool exports during April to November 2025. |

Favorable Global Conditions

Average global crude oil prices declined from US$ 63 per barrel in October 2025 to US$ 62.3 per barrel in November 2025, marking the lowest level since February 2021 amid easing supply conditions. Meanwhile, the OECD (Organisation for Economic Co-operation and Development) projected global growth at 3.2 percent in 2025 and 2.9 percent in 2026, with India’s growth forecast at 6.7 percent in FY26 and 6.2 percent in FY27.

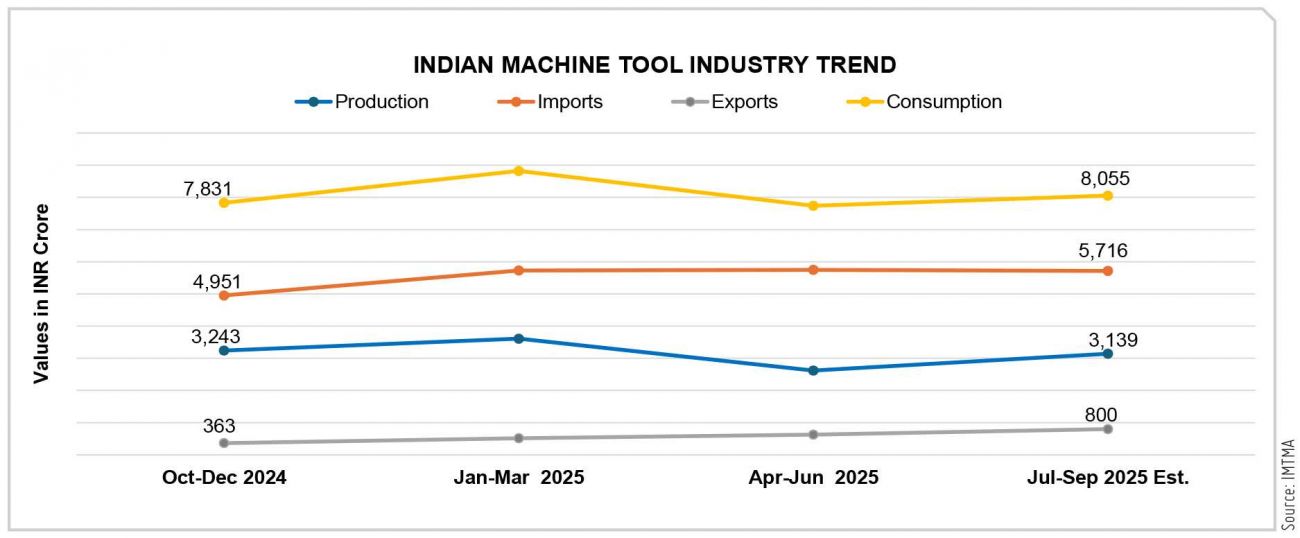

Machine Tool Industry Performance

Production of machine tools during H1FY26 (April–September 2025) increased by 12 percent year-on-year to INR 5,755 crore (US$ 665 million). Orders booked during the same period stood at INR 6,886 crore (US$ 796 million), registering a 14 percent increase. Imports rose sharply by 43 percent year-on-year to INR 11,464 crore (US$ 1,326 million) in H1FY26, while machine tool exports in H1FY25 surged by 140 percent to INR 1,425 crore (US$ 165 million). Consumption is estimated to have grown by 26 percent to INR 15,794 crore (US$ 1,827 million) in H1FY26.

Sharp Rise in Imports

Total machine tool imports reported from April to November 2025 reached INR 14,923 Cr (US$ 1.7 billion), with 36,161 units of machines imported. China (29%), Japan (23%), and Germany (13%) emerged as the top countries for imports, contributing to 65 percent of the total machine tool imports. Presses (18%), Vertical Machining Centers (VMCs) (12%), and Lathes (9%) were

the top machinery types imported, valued at INR 5,842 Cr (US$ 673 million), constituting approximately 39 percent of total machine tool imports during the period.

Exports Improve

While for exports, total machine tool exports from April to November 2025 reached INR 1,831 Cr (US$ 210 million), with 5,725 units of machines exported

Source: Data & Policy Team, IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe