FOCUSING ON GROWTH

Realizing the strategic importance of sectors such as defence, aerospace, space, and aviation, the Government of India has earmarked them for growth. The development in each of these domains gets percolated to other sectors and impacts the overall growth of technology and economy of the country, also providing significant opportunities for the Indian machine tool industry.Realizing the strategic importance of sectors such as defence, aerospace, space, and aviation, the Government of India has earmarked them for growth. The development in each of these domains gets percolated to other sectors and impacts the overall growth of technology and economy of the country, also providing significant opportunities for the Indian machine tool industry.

The Defence, Aerospace, Space, and Civil Aviation sectors are evolving in India, attracting bigwigs from various quarters. As per the Central Government estimates, India was among the top five countries with the highest military spending in 2019. It has the second-largest standing army in the world and the union budget of 2021-22 has proposed increased funding for Border Roads Organisation to boost infrastructure in frontier areas.

Indian defence capital outlay is expected to reach an estimated $23 billion by 2025. It is to be noted that defence public sector undertakings invested an estimated $95 million in plant and machinery while the demand outlay for plant and machinery by the Defence industry was approximately $120 million per annum. The Defence Research and Development Organisation (DRDO), the premier agency under the Ministry of Defence, Government of India, has set up more than 50 labs in India for defence technology development. More than 40 Ordnance Factories and nine defence public sector units (DPSUs) are involved in defence production.

The country has more than eight advanced technology centers for the development of futuristic technologies at premier academic institutions such as the Indian Institutes of Technology in Mumbai, Chennai and Delhi; Jadavpur University; Bharatiyar University; etc. The private sector has also been involved in the defence production in a big way since 2001 and more than 10,000 MSMEs are involved in the defence supply chain. India has allocated an estimated $45 billion for defence budget for 2020-2021. India’s defence exports have risen by over five times in the last four years with the total exports rising from an estimated $204 million in 2016-17 to around $398 million in 2020-21.

The FDI limit for defence has been raised from 49 to 74 percent in the automatic category and more than 5,000 products are expected to be indigenized by 2025. Foreign players establishing manufacturing set-up in India need to invest in plant and machinery which is favorable for the Machine Tool and Manufacturing sectors. With the Government launching the scheme for the promotion of MSMEs in Defence, preference is being accorded to indigenously designed, developed, and manufactured products. Conventionally, Bengaluru-based large public sector undertakings such as Hindustan Aeronautics Ltd (HAL), DRDO, Gas Turbine Research Establishment (GTRE), Aeronautical Development Agency (ADA), BEML (previously Bharat Earth Movers Ltd), Bharat Electronics Ltd (BEL), National Aerospace Laboratories (NAL), etc. along with Ordnance Factories in different parts of the country have been involved in defence production. However, the recent decision of the Government to corporatize the Ordnance Factory Board (OFB) is expected to encourage the entry of larger private entities in defence manufacturing, which may be a step in the right direction. The establishment of industrial corridors in Uttar Pradesh and Tamil Nadu will foster defence manufacturing in the medium to long run.

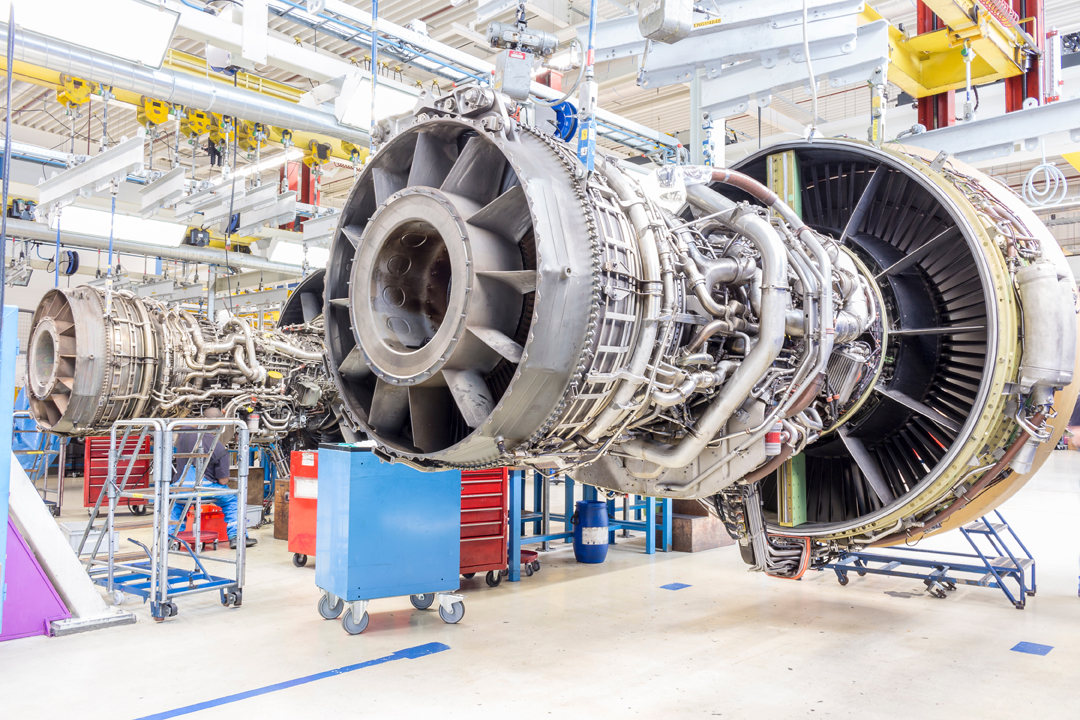

The Indian Aerospace sector is growing significantly on the back of the progress made by the Defence and Civil Aviation sectors. We are witnessing an increased demand for aircraft besides the rise in defence capital expenditure paving way for opportunities in defence and aerospace. In the long-term, the Indian aerospace and defence market is pegged to reach $70 billion by 2030, providing significant opportunities for production, maintenance, repair, overhaul, and sales for civil and defence applications.

As per Economic Survey 2020-21, India spent about $1.8 billion on space programs in 2019-20. FDI up to 100 percent is allowed in satellites establishment and operations, subject to sectoral guidelines by the Department of Space or ISRO (Indian Space Research Organisation). The Space industry is growing at a good pace with rocket production and an increase in the number of satellite launches by ISRO. India announced itself as a player in space exploration by launching the civilian moon mission – Chandrayaan 2 and is also planning for a manned space mission – Gaganyaan.

India’s Aviation sector contributes $30 billion to the national GDP and the domestic Aviation market is projected to rank 3rd globally by 2024. The country is one of the fastest-growing aviation markets with the International Air Transport Association (IATA) expecting India to cater to 520 million passengers by 2037.

India can stay in the race only through investments in technology and intense R&D. With the

Government and industry working together, tangible results can be achieved

and the vision of Make in India and Atmanirbhar Bharat can be realized.

Favorable policies

The Union and State governments are lending ample support through friendly policies and space for investments. To provide impetus to self-reliance in defence manufacturing, many announcements were made in the ‘Atmanirbhar Bharat Package’. In furtherance to this, the Ministry of Defence released the Defence Production and Export Promotion Policy 2020 which envisages achieving a turnover of around $23 billion including export of about $4.7 billion in aerospace and defence goods and services by 2025.

In a recent development that could have wider ramifications in the Aero-Defence sector, Karnataka is coming up with a new aerospace and defence policy. Industry analysts opine that the state is likely to announce some new investments that would encourage global companies that already have a presence in the aerospace park and aerospace special zone on the outskirts of Bengaluru. Other cities such as Hyderabad and Chennai are also emerging as aerospace, defence and aviation hubs attracting investments from large corporations for manufacturing aero-structures, fuselage, and engine spare parts.

Manufacturing galore

Undoubtedly, these sectors look for MSMEs with proven solutions to meet their supply chain and aggregate requirements. The Manufacturing industry needs to brace up to offer critical components and assemblies which are currently imported. The Manufacturing industry, particularly the Machine Tool industry, needs to consider deploying high-technology, high-precision machinery for ultra-precision machining, superfinishing, exotic material machining, multi-tasking, precision flow forming, 3D printing, etc. The industry needs to build high-quality machines with high-quality workmanship, which also means employing a workforce with good quality skill sets. India can stay in the race only through investments in technology and intense R&D. It is a challenging and demanding journey but with the Government and industry working together, tangible results can be achieved and the vision of Make in India and Atmanirbhar Bharat can be realized.

Source: IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe