POISED FOR EXPANSION

India’s machine tool industry is riding a growth wave, buoyed by domestic consumption and rising infrastructure. While exports dipped, strong production growth, rising imports, and consumption suggest increased local demand and industrial activity.

In FY2024–25, real GDP growth stood at 6.5 percent. Growth momentum strengthened in the final quarter, with Q4FY25 GDP rising to a four-quarter high of 7.4 percent, up from 6.4 percent in Q3FY25. However, indicators such as the manufacturing PMI (Purchasing Managers’ Index) eased to 57.6, though it remained above its long-run average of 54.1. The services PMI continued to remain at a high level of 58.8. IIP (Index of Industrial Production) growth moderated to 2.7 percent in April 2025, driven by weaker growth in manufacturing and electricity output.

Inflation Trends

Inflation trends continued to ease, with CPI (Consumer Price Index) inflation falling to a 75-month low of 2.8 percent in May 2025, largely due to lower food prices. Core CPI also moderated slightly to 4.3 percent, down from 4.4 percent in April 2025. WPI (Wholesale Price Index) inflation declined to 0.4 percent in May 2025, its lowest level since May 2024, driven by a drop in prices of food items, metals, and mineral oils.

On the fiscal front, the Government of India’s fiscal deficit stood at 4.8 percent of GDP, aligning with the FY25 Revised Estimates (RE). The revenue deficit improved to 1.7 percent of GDP, compared to 1.9 percent projected in the FY25 RE.

External Sector and Crude Prices

On the external front, merchandise exports and imports showed a contraction of (-)2.2 percent and (-)1.7 percent in May 2025, as compared to growth rates of 9.0 percent and 19.1 percent in April 2025. The merchandise trade deficit eased to US$ 21.9 billion in May 2025 from a five-month high of US$ 26.4 billion in April 2025.

In May 2025, the average global crude price fell to US$ 62.7/bbl, its lowest level since February 2021, amid escalating US tariffs and larger-than-expected output hikes by OPEC+. More recently, heightened geopolitical tensions due to the Israel-Iran conflict pushed the daily Brent crude price to a peak of US$ 77.08/bbl.

Indian Machine Tool Industry Outlook

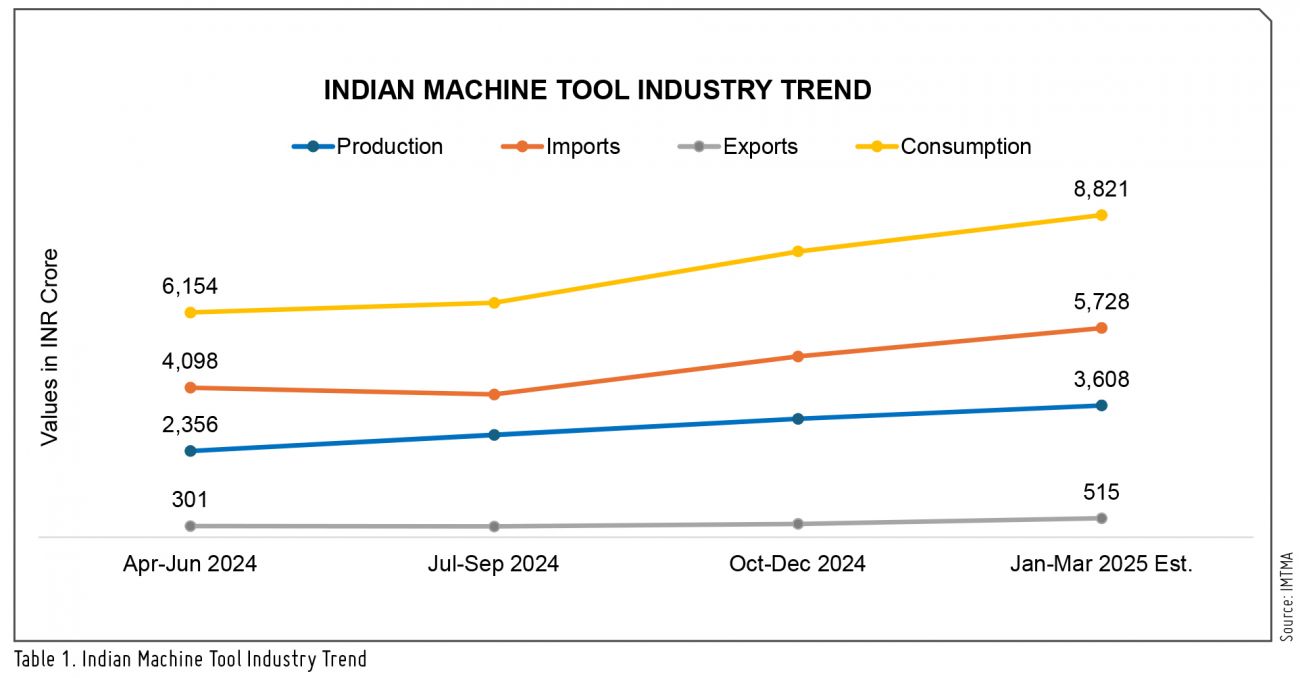

According to inputs from CECIMO on the World Machine Tool Industry Outlook, India is ranked 9th globally in production and 4th in consumption in CY2024. As per revised estimates from IMTMA (Indian Machine Tool Manufacturers' Association), Indian Machine Tool industry production in FY25 is estimated to have increased by around 7 percent year-on-year, reaching about INR 14,566 crore (US$ 1.7 B). The industry's imports in FY25 saw a rise of 22 percent year-on-year, amounting to INR 18,686 crore (US$ 2.2 B). Machine tool exports from India during FY25 reported an 11 percent degrowth, totalling INR 1,472 crore (US$ 173 M), and consumption is estimated to have increased by about 17 percent to reach INR 31,781 crore (US$ 3.7 B) in FY25.

|

In exports, Russia (48%), China (9%), and UAE (6%) emerged as the major destinations, collectively representing 63 percent of total machine tool exports in Q1 FY26, amounting to a total export value of INR 625 crore (US$ 73 M). |

Import Composition – Q1 FY26

In Q1 FY26, Japan (26%), China (24%), and Germany (15%) emerged as the top countries for imports to India, contributing to 65 percent of the total machine tools imports. Presses (21%), VMCs (17%), and HMCs (8%) were the top three machinery types imported, valued at INR 2,616 crore (US$ 306 M), constituting about 46 percent of total machine tool imports during the period. Imports from Asian nations like China, Japan, South Korea, and Taiwan contributed 62 percent of total imports during Q1 FY26.

Export Trends – Q1 FY26

In exports, Russia (48%), China (9%), and UAE (6%) emerged as the major destination, collectively representing 63 percent of total machine tool exports in Q1 FY26, amounting to a total export value of INR 625 crore (US$ 73 M). Among the machinery types, VMCs (47%), Lathes (9%), and Presses (9%) stood out as the top three machinery types exported, with a combined value of INR 409 crore (US$ 48 M), accounting for about 65 percent of total machine tool exports during Q1 FY26.

Source: Data & Policy Team, IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe