HARNESSING AR CAPABILITIES

A report exploring the robust and increasingly complex opportunities presented by the Industrial Augmented Reality (AR) market, and also shedding light on the actionable trends and insights across the entire AR ecosystem…

MIKE CAMPBELL, EVP - Augmented Reality Products, PTC

SHAWN KELLY, VP - Corporate Strategy, PTC

JONATHAN LANG, Lead Principal Business Analyst, PTC

DAVID IMMERMAN, Business Analyst, PTC

Augmented Reality (AR) has lately been recognized nearly universally as a top business imperative by the leading analyst firms, and for enterprises undergoing digital transformation, making the time right to integrate AR into the technology roadmap. Moving quickly from pilot to production, industrial enterprises are quickly recognizing optimization of their workforce as AR reduces training time and costs to bridge the growing worker skill gap through knowledge transfer and improves quality and first-time success rates to drive operational efficiencies.

This edition of our State of Industrial Augmented Reality series examines the market trends for enterprises across industrial verticals for their own internal use to improve workforce productivity.

Our key findings include:

- Industrial enterprises are the highest adopters of AR, focusing efforts on improving worker performance and solving the skilled labor shortage they are experiencing.

- Use cases for worker productivity focus on delivering instructions and guidance primarily within manufacturing, service, and training environments.

- Companies piloting AR initiatives are experiencing dramatic gains in worker efficiency and quality, while reducing the cost of training by more effectively transferring knowledge to new workers.

- Successful pilot programs are being moved to production at higher rates year-over-year to capitalize on the early mover competitive advantage

Methodology

The insights contained in this edition of the State of Industrial Augmented Reality report series have been developed through primary and secondary market research conducted. The primary research includes exclusive data related to one of the largest sets of industrial enterprises pursuing AR in the market—companies testing PTC Vuforia software. These enterprises include a global sample representative of multiple verticals with a focus on industrial settings. We supplement this proprietary data with market projections and case studies from dozens of analyst firms and consultancies in the broader market. The State of Industrial Augmented Reality distils this vast set of knowledge and provides a comprehensive view of the current state of the market. In this update, we’ll focus on findings from our cumulative three years of research data and provide insight into industrial enterprises capitalizing on the opportunity presented by industrial AR to optimize their workforce.

Facing increasingly complex and digital processes and products, coupled with an acute skilled labor shortage, industrial enterprises are bridging the gap with the help of AR technology.

Demographics, drivers, and beneficiaries

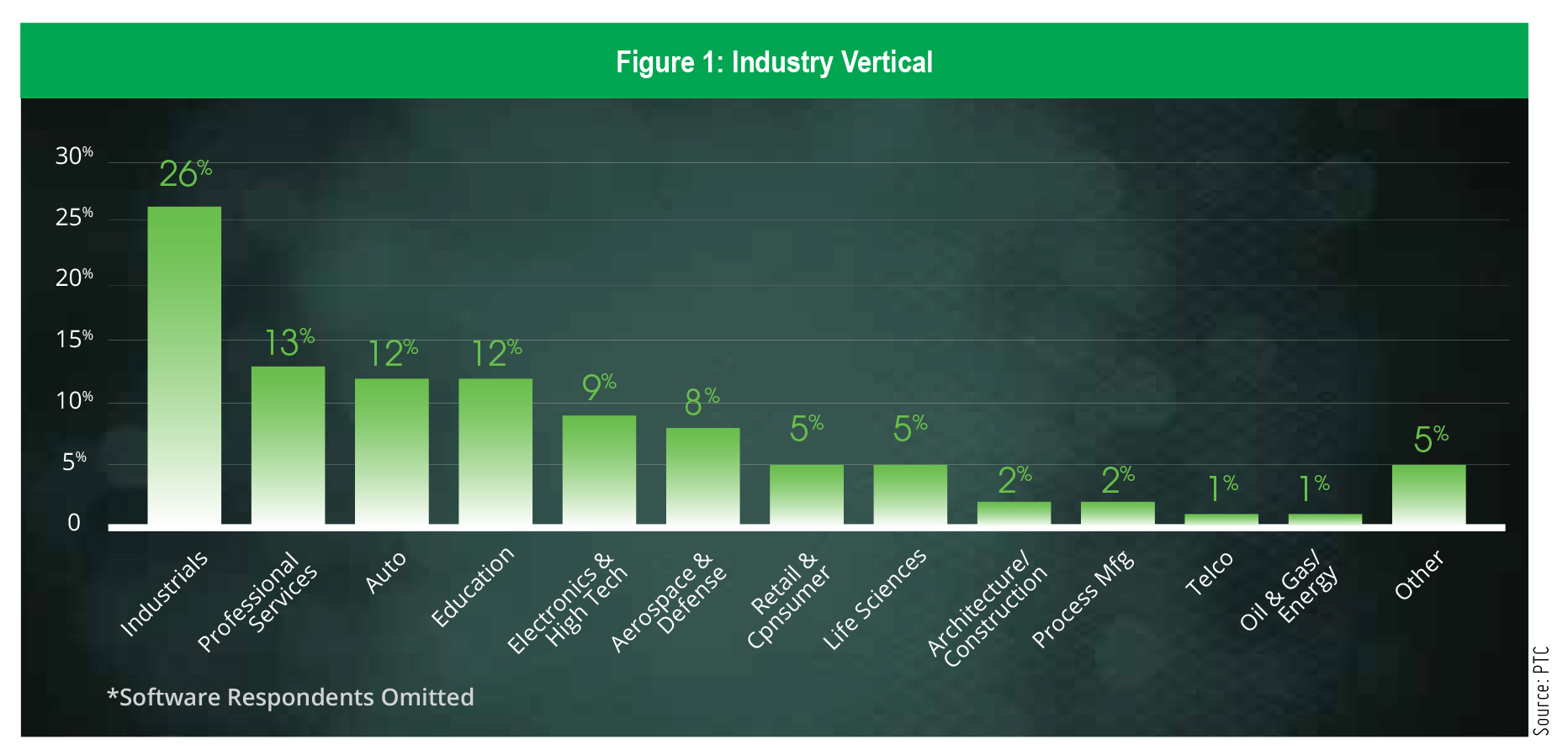

With a majority of survey respondents falling into the industrial category, AR has found its greatest value in verticals bearing heavy physical product or process components. It should come as no surprise that 26 percent of responses are representative of industrial products with an additional 29 percent from industrial verticals such as Automotive, Electronics and High Tech, and Aerospace and Defense. Facing increasingly complex and digital processes and products, coupled with an acute skilled labor shortage, industrial enterprises are bridging the gap with the help of AR technology.

Prediction is that this concentration of deployments in industrial environments will continue to consolidate, as AR moves from hype to reality and real-world deployments prove themselves to create the greatest value in these domains.

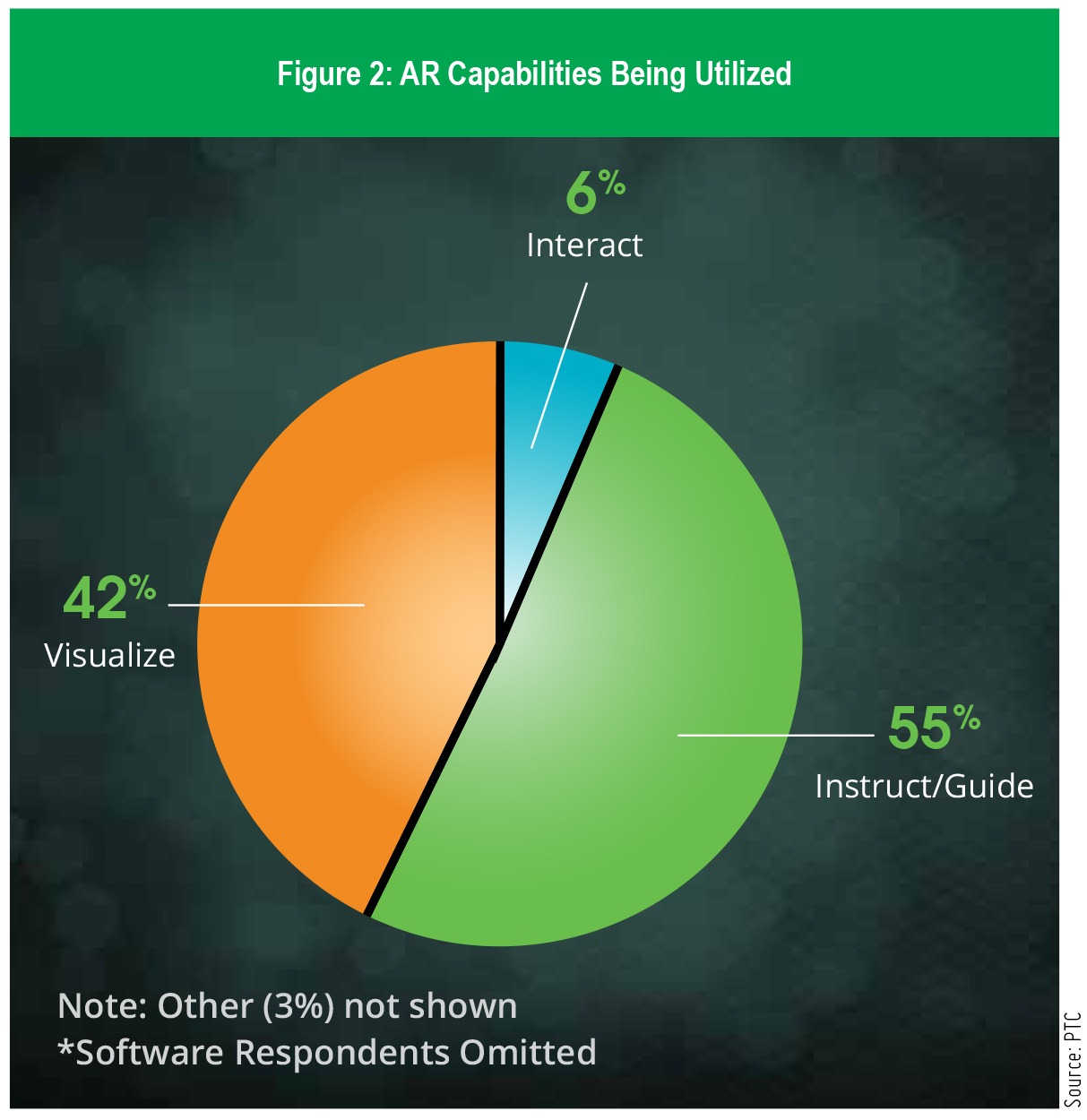

Trending in line with our previous research, most enterprises today are adopting AR for their internal use and benefit, marking improvements in ‘Operational Efficiency’ or ‘Lower Costs’ as main value drivers according to our data. To achieve these benefits, use cases being developed are leveraging AR to provide instruction or guidance. Interacting or using AR to manipulate digital graphics or interface with a smart, connected product is an emerging capability that will grow as AR becomes integrated with more business and product control systems. Whether the aim is to centralize and scale expertise to achieve cost savings in travel and logistics, or reduce workers’ ramp time to learn new tasks, worker distribution and development is receiving a welcome overhaul thanks to the new capabilities AR provides. This is in contrast to use cases focused on visualization, which are mainly being used as new methods for customers to engage with products and brands.

Most enterprises today are adopting AR for their internal use and benefit, marking improvements in ‘Operational Efficiency’ or ‘Lower Costs’ as main value drivers.

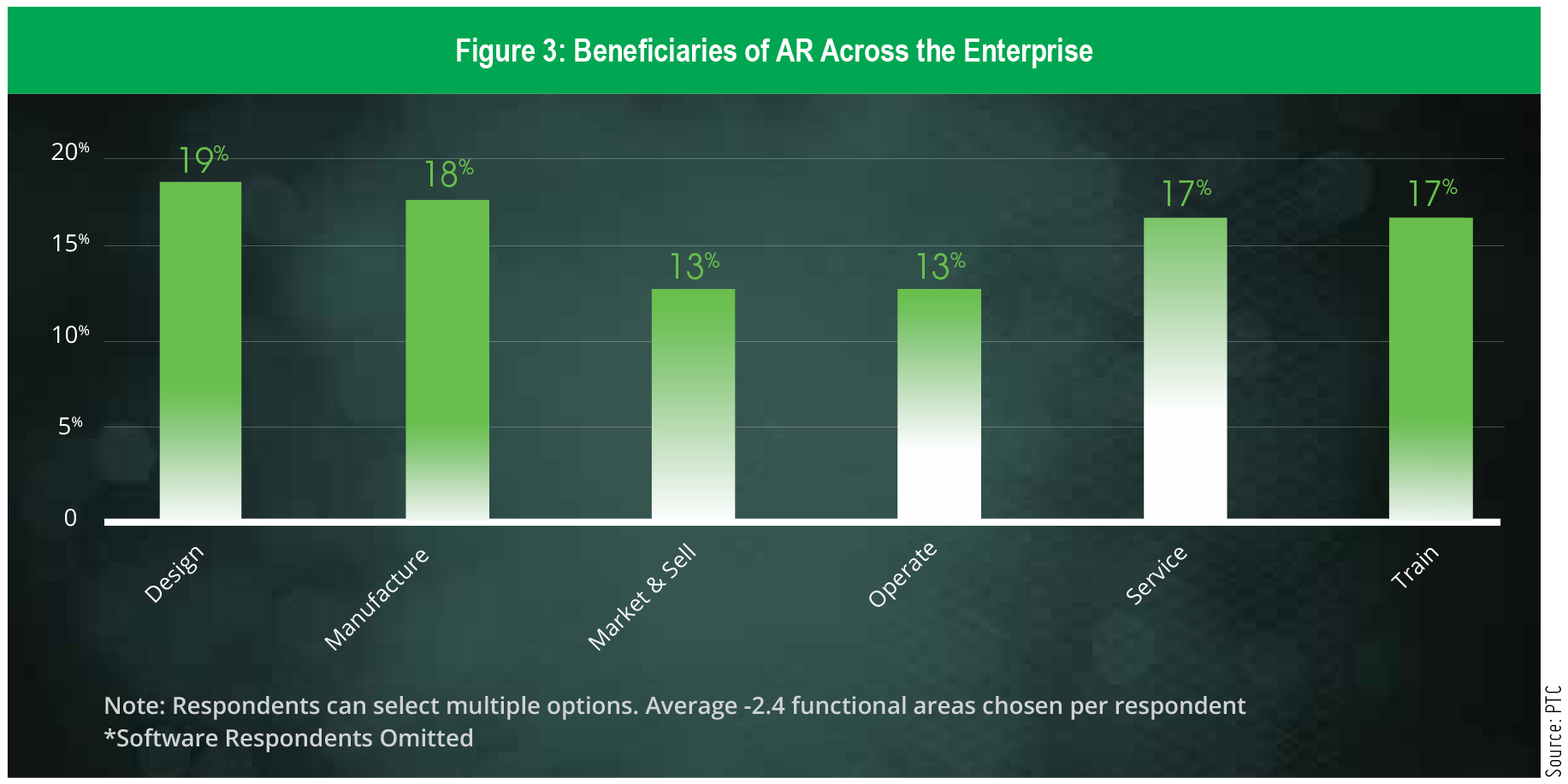

Opportunities to leverage these capabilities across the value chain are diverse, with heaviest concentrations in design, manufacturing, service, and training. Design use cases typically drive value through ‘design for manufacturability’ or ‘design for service’ value propositions, where designers visualizing products at scale can engineer based on manufacturing and service efficiencies or ergonomics. In this way, downstream productivity is gained by a reduction in design iterations, and by working those downstream efficiencies into the design requirements more efficiently.

For manufacturing, service, and training-centric beneficiaries, use cases are most often utilizing step by step instructions to speed the completion of tasks and improve work quality and collaboration among workers. As consumer expectations rise, these types of initiatives yield not only internal workforce benefits, but ultimately improve relationships with customers and supply chain partners, providing competitive advantages as well.

Top AR use cases and examples of workforce optimization

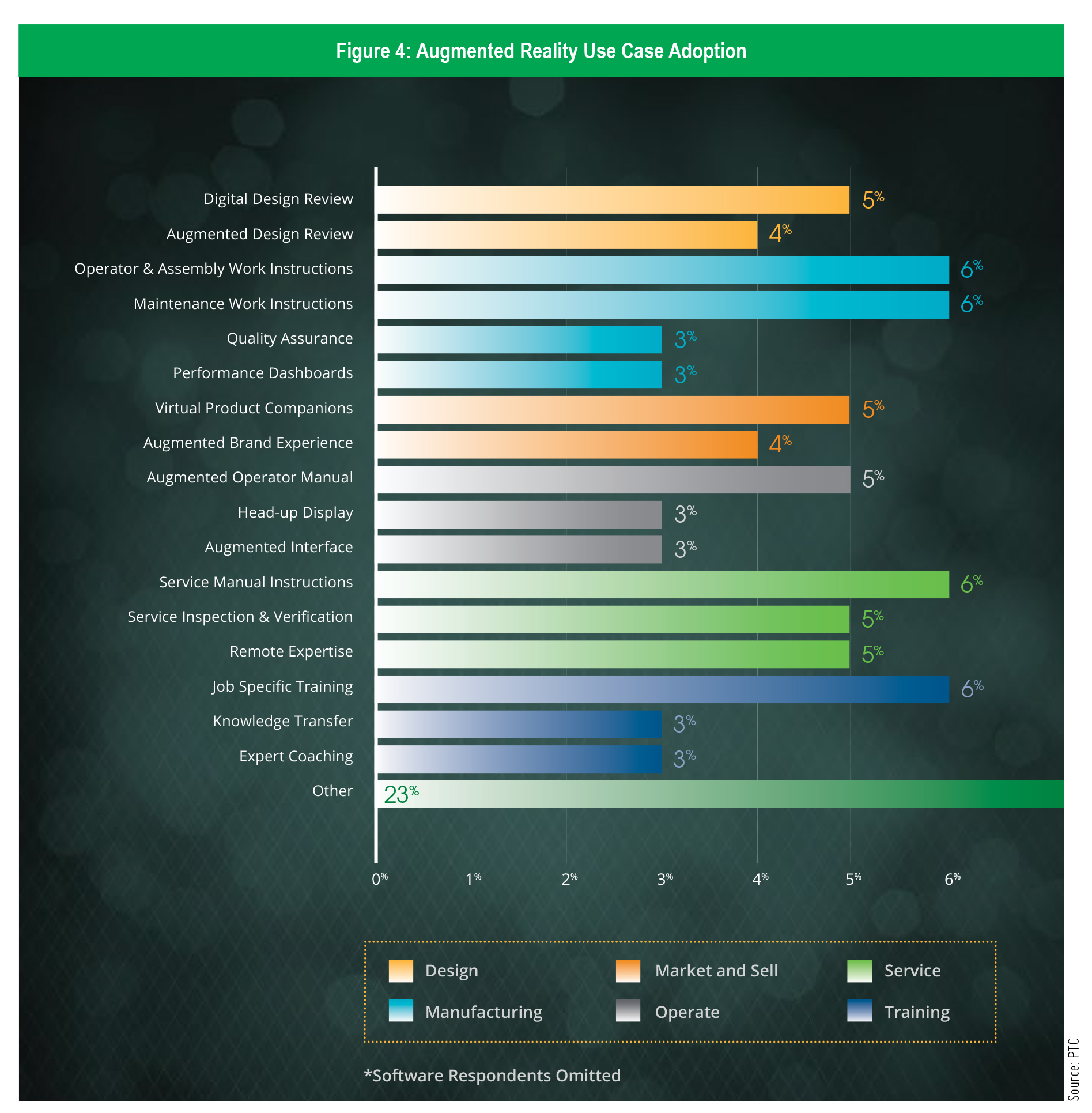

Industrial enterprises are focusing on harnessing the new AR capabilities across their value chains. Many early AR deployments have showcased the exciting new potential of AR through product and brand experiences. The launch of Porsche and other major brands ‘digital showrooms’ is proof of the transformative potential of AR to impact marketing and sales. AR can certainly shorten the sales cycle and improve close rates, but as the technology matures, industrial companies are turning their focus to embedding AR within their critical processes to optimize their workforce.

The launch of Porsche and other major brands ‘digital showrooms’ is proof of the transformative potential of AR to impact marketing and sales.

For industrial enterprises offering AR experiences to enhance their workforce, a staggering 69 percent of use cases are focused on benefitting their internal workers in engineering, manufacturing, service, and training. This trend is in line with broader market observations, and step-by-step instructions have quickly become the default starting point for anyone experimenting with AR. The way in which information has been documented, maintained, and shared has historically been slow and costly.

More importantly, for the worker accessing it, the abstract context of a drawing or text-based instruction, and even out-of-context video, creates significant cognitive burden and slows work processes significantly while opening them up to errors. According to a recent Manufacturing Workforce Training Survey conducted by Informa, 75 percent of manufacturers view ‘on the floor pairing’ or shadowing as the most effective way to train workers, followed by a paltry 15 percent for classroom methods. Indeed, the power of context cannot be overstated when dealing with complex and variable tasks in ever-changing environments characteristic of industrial jobs. Yet 1:1 expert training is costly and inefficient, requiring more time from seasoned workers than enterprises can afford, and producing logistical challenges that do not scale. With AR, these challenges are significantly reduced and industrial enterprises are welcoming its new capabilities in a much-needed overhaul of knowledge transfer and workforce development at a time when the skill gap and retirement of the previous workforce has caused an acute bottleneck.

These types of results are becoming increasingly common as more industrial enterprises make the commitment to pilot this promising new technology. One unique and necessary evolution in the way industrial enterprises conduct their operations is the need for agile, real-time worker development and learning without sacrificing time and productivity. The re-use of pre-work training content for in-situ work instruction is producing cost savings not only in the development and delivery of training materials, but it’s also reducing the unproductive time spent by workers to consume it. The prediction is that over time the need for out-of-context learning and development will be limited to regulated certifications and necessary safety training, while standard work instructions and job training will happen in-situ thanks to AR.

Deployment methods and timeline

When most people think of AR, they picture a head-mounted display like the Microsoft HoloLens. According to PTC data, 24 percent of enterprises experimenting with AR have done so with the aid of these futuristic devices. Indeed, for industrial workers performing complex tasks with both hands, the need for a hands-free experience is paramount. But considering 62 percent and 55 percent of respondents who are making experiences available on smartphones or tablets, there is a clear opportunity to develop platform-agnostic AR experiences today that will be accessible to HMDs as they become available.

With the announcement of HoloLens 2 at Mobile World Congress in February 2019, one becomes sure of a significant progress toward the hands-free AR of the future. We, therefore, predict this trend of smartphone-led AR pilots to begin to shift, favoring more sophisticated hands-free devices. With regard to the timeline that enterprises foresee advancing their pilots, an impressive 68 percent feel confident that they will move their AR initiatives to production within 12 months. While the number of enterprises in production with AR at scale today remains low, with the level of value being reported by trailblazers like BAE, there is no doubt these timelines will continue to shorten. This is particularly true considering the growth in ready-to-deploy solutions becoming available in the market, driven by the clear strategic focus areas of enterprises that have been testing this technology in recent years.

The bigger picture

The bigger pictureOur research and analysis show that industrial enterprises are exiting the awareness phase and are working quickly to integrate AR into their digital transformation strategy to optimize their workforce and beyond.Market analysts’ and PTC’s forecasts predict that industrial augmented reality has the potential to create significant economic disruption and impact. To capitalize on this opportunity, industrial enterprises should seek partners and technology providers that have solutions ready to deliver value and build, integrate, and deploy AR experiences as quickly and easily as possible.

While the number of enterprises in production with AR at scale today remains low, with the level of value being reported by trailblazers like BAE, there is no doubt these timelines will continue to shorten.

BAE Systems

Take BAE, the multi-national aerospace and defence company, for example. BAE has piloted operator and assembly work instructions to improve the speed and accuracy of assembly procedures, and more quickly and inexpensively roll out new information to workers. Using AR, the company is able to create work instructions to deliver to workers ‘in hours, at a tenth of the cost’ of previous methods. And according to one BAE Operations Associate, AR has enabled them to cut their assembly time in half. Leveraging these instructions for training, BAE has been able to train new employees ‘30-40 percent more efficiently’. With these kinds of staggering improvements to worker productivity, it comes as no surprise that BAE views AR as ‘the next step in the evolution of high-tech manufacturing’.

Lead image:

Source: Magic Wand Media

Inside graphics:

Source: PTC

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe