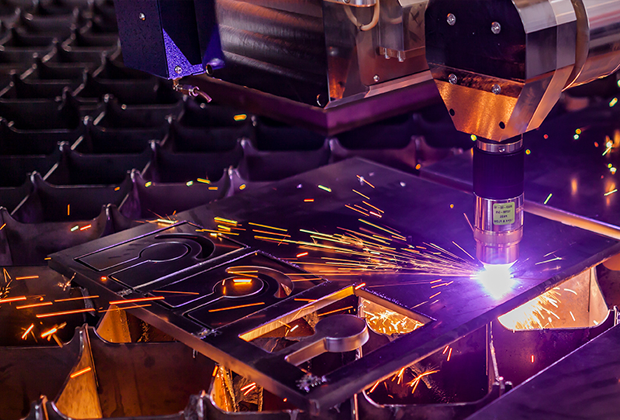

Italian Machine Tool Industry Thrives in 2022, Anticipates Order Intake Challenges in 2023

Cinisello Balsamo, Italy – Italian manufacturing industry of machine tools, robots, and automation systems experienced an extremely positive year in 2022, which registered double-digit increases and set new records for most economic indicators, among them production and consumption. With these results, once again, the Italian industry of the sector confirmed to be one of the key players in the international scenario, where it came in fourth in the ranking of production, exports, and consumption.

The year 2023 will still close with a positive sign, and thus with new records for the sector, but the order intake for the first part of the year showed a rather marked slowdown caused by the general atmosphere of uncertainty. This is the framework summed up by Barbara Colombo, President, UCIMU-SISTEMI PER PRODURRE—the Italian Machine Tools, Robots & Automation Manufacturers Association—during the recent Members’ Meeting, which was also attended by Adolfo Urso, Minister for Enterprises and Made in Italy (via video link), Gian Maria Gros-Pietro, Economist and President, Intesa Sanpaolo, and Federico Visconti, Rector, LIUC Cattaneo University.

The actual results of 2022

According to the final data processed by the Economic Studies Department & Business Culture Centre of UCIMU, in 2022, the Italian production of machine tools, robots, and automation systems reached €7,280 million, recording a 15 percent increase versus 2021. Consumption grew by 26 percent to €6,311 million, leading to a rise both in domestic deliveries (€3,812 million; +21.6%) and in imports (€2,499 million; +33.3%). Exports also increased to €3,468 million in 2022, i.e., 8.5 percent more than in the previous year. The exports-to-production ratio dropped from 50.5 percent in 2021 to 47.6 percent in 2022.

In 2022, the main export markets for the Italian product offering were the United States (€482 million, +43.5%), Germany (€306 million, -13.3%), China (€226 million, -0.7%), France (€193 million, +9.6%), Poland (€188 million, +6.2%), Turkey (€124 million, -3.9%), Spain (€119 million, +19.7%), Russia (€99 million, -3.9%), Mexico (€84 million, +5.2%), and Switzerland (€74 million, +36.8%). The positive performance of the Italian industry of the sector had a positive impact on the utilization of production capacity, whose annual average went up significantly, going from 80.2 percent in 2021 to 86.6 percent in 2022. The order portfolio was also on the rise, attaining 8 months of guaranteed production versus 7.3 in the previous year. The turnover of the sector achieved the amount of €10,482 million.

Forecasts 2023

Based on the forecasts elaborated by the Economic Studies Department & Business Culture Centre of UCIMU, the year 2023 should also close with a positive trend, but the order intake of the first half of the year is at a standstill. Production should stand at €7,750 million, i.e., 6.5 percent more than in the previous year, thus marking a new absolute record in the history of the Italian industry of the sector. Consumption should rise to a new record-breaking value of €6,835 million (+8.3%), driving the manufacturers’ deliveries to the domestic market, which should achieve a new record, amounting to €4,155 million (+9%). Imports should also go up, attaining the value of €2,680 million (+7.3%). Exports should grow to €3,595 million (+3.7%), thus returning to the pre-Covid levels.

Based on UCIMU processing on ISTAT data, in the first three months of 2023, the main export markets of the Italian machine tool offering were the United States (€126 million, +35.4%), Germany (€89 million, +43.8%), China (€55.5 million, +23.3%), France (€54 million, +33.9%), Poland (€38 million, +10.2%), Turkey (€34 million, +86.8%), Mexico (€29 million, +49.7%), Czech Republic (€27 million, +118%), Spain (€25 million, -16.5%), and India (€24 million, +38.9%).

Comments and proposals on industrial policy

The President of UCIMU-SISTEMI PER PRODURRE, stated, “If we analyze the trend in the last three-year period 2021-2023, it is clear that the Italian machine tool industry has become stronger after the public health crisis, which it was able to face more effectively and energetically than many competitors, starting with Germany. These results prove our capabilities and the value of our agile and strongly innovation-oriented model of enterprises.”

“For several years now, companies in the sector have been working in a situation that could be defined as ‘unusual business’, in which changes of scenario are a constant variable. It is not easy, but we do and will do again in the future,” she added. “In response to the situation of general uncertainty that actually affected our order collection in the first half of the year, our enterprises have identified some challenges on which they intend to concentrate in the medium-long term future, in order to strengthen their positioning in the international market: innovation that translates into digitalization&sustainability, availability of skilled personnel, servitization, and internationalization.”

Digitalization&Sustainability

Nowadays, the real challenge for manufacturers with regard to innovation is the digitalization&sustainability combination. This translates into the capacity of developing systems, which ensure efficient processes for users, i.e., characterized by an appropriate use of resources and adequate production time, as well as into the possibility of measuring the environmental impact (e.g. carbon footprint) at every stage of the manufacturing process. However, such a rapid evolution in the innovation processes, in which companies are playing a leading role, cannot do without a support action by the economic and industrial Country System.

“For this reason, we ask the Government authorities to confirm and strengthen the Transition Plan 4.0, which, in our opinion, must structurally provide for a modular system of tax incentives that can be combined and cumulated and may more considerably reward those who invest in new machines, whereby digitalization also enables sustainability,” Colombo stressed. “In particular, we think that, in addition to the first measure—the one that is currently in force, consisting in the tax credit for investment in state-of the-art digital production technologies—there should be another tax credit for investment in machines that are integrated together to create a system implementing the two value chains, the physical and the digital one. Finally, there should be a third measure that can ensure a tax credit for sustainability, in order to push enterprises towards ‘green manufacturing’, in line with thepean directives.”

Availability of skilled personnel

Italian machine tool companies have great difficulty in finding skilled personnel trained to operate in their plants. Indeed, globalization and digital transformation impose a significant revision of the skills required of employees and drive the emergence of new professional figures that did not exist before. Two particularly interesting aspects emerge from a recent survey conducted by UCIMU on the ‘Need for professional figures and professional skills of companies in the sector’. The first aspect: some technical figures that could be defined as ‘traditional’ are still central to the activities of enterprises in this industry and are difficult to find. The second aspect: for the future, the figures with digital and automation skills, as well as management competence are those of greatest interest to the companies in the sector. This means that we need to get in touch both with young graduates from technical institutes and ITS (Higher Technical Institutes) and with university graduates, not only in engineering.

To reduce the mismatch between job demand and supply, companies often enter into cooperation agreements with technical institutes in their areas, so that the institutes themselves can become nurseries from which to draw for their employment needs. In this activity, they are supported by associations, such as UCIMU, which directly operate to encourage the dialogue between the world of school and academic education & training and the world of enterprises, also with the aim of better targeting their education curricula, so that they can be more in line with the real needs of enterprises. However, this is a complex and articulated work, whose results will be seen in the medium-long term. Therefore, it is essential that the Country System can directly support Schools and Universities, by adapting the curricula of educational pathways at all levels to the changes in the context. “On the other hand, we ask the Government authorities to confirm, also for the future, the applicability of tax credit for education and training, which is essential to support companies in a rapid refresher training and re-qualification process of their staff,” she asserted. “Finally, labor cost, which increased by 6.6%, is a further problem for the enterprises that have to hire personnel, so we ask the Government authorities to intervene by reducing tax wedge.”

Servitization

More and more companies in the sector are working on developing an offer that includes, in addition to the sale of the physical product (the machine), a series of value-added services that can improve the user’s satisfaction. This activity could also become an interesting, additional source of income for manufacturers. Moreover, along the lines of what has already happened in other sectors, UCIMU is developing, together with some accredited partners from the leasing world, the issue of sales through operational rental, in order to monitor an activity that is slowly approaching the machinery sector.

Internationalization

“Exporting is our first way of being present in the international market, but it cannot and must not be the only one. Our enterprises are aware of that and are structuring themselves, in order to better seize the opportunities (even the untapped ones) offered by foreign demand, both from traditional economies, such as those of EU countries and the USA, and from emerging economies, such as China, India, Vietnam, and Turkey,” Colombo said. “Companies take advantage of their participation in international trade fairs, but also of their own network of sales agents. Then, there are companies that have offices or branches, mostly sales offices or after-sales service points. On the other hand, few enterprises have production facilities abroad and on this we must still improve.”

The medium-small size of companies in this industry makes the setting-up of production sites around the world extremely complex. Therefore, the enterprises of this sector have been organizing themselves to be present in several areas by using alternative ways that may be functional to their business targets. For example, this is the case of business networks, whose creation was spurred by the Association, and which bring together several member companies. In particular, UCIMU is currently engaged in the establishment of the Business Network in Vietnam, modeled on the successful ITC India, established more than a decade ago and confirmed until 2026.

In addition, in support of internationalization activities, UCIMU has been acting with ad hoc initiatives, carried out independently or sometimes with the participation of institutional partners, among which SACE, SIMEST, and ICE-Italian Trade Agency. “In this regard—concluded Colombo—we ask the Government authorities for more resources to invite foreign buyers to Italy and, as soon as possible, for the reopening of Fund 394. We hope that this fund may be open not only to SMEs, but also to Mid-Caps, (which drive the production chain) for non-repayable and low-interest financing of internationalization activities, such as, for example, setting-up of offices and branches and creation of business networks abroad, as well as development projects regarding ecological and digital transition and participation in international trade fairs.”

Image Source: UCIMU

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe