OPTIMISM IN THE AIR

India’s economic landscape showcased resilience and promise in the third quarter of the fiscal year 2023-24, driven by robust performances in key sectors.

With a remarkable double-digit growth rate of 11.6 percent in manufacturing and a solid 9.5 percent growth in construction, India’s real GDP surged by 8.4 percent in the third quarter of FY2023-24. This growth trajectory was buoyed by a sharp increase in both manufacturing and services PMI levels, reaching 56.5 and 61.8 respectively in January 2024.

Accompanying this positive trend was an uptick in the Index of Industrial Production (IIP) growth, which rose to 3.8 percent in December 2023. Despite a slight moderation from the previous quarter, the IIP growth averaged at 5.8 percent, indicating sustained industrial momentum.

In its monetary policy review, the Reserve Bank of India (RBI) retained the repo rate at 6.5 percent in February 2024, underscoring its commitment to balancing growth with inflation management. Both the consumer price index (CPI) and wholesale price index (WPI) exhibited favorable trends, with CPI inflation easing to 5.1 percent and WPI inflation falling to 0.3 percent in January 2024.

|

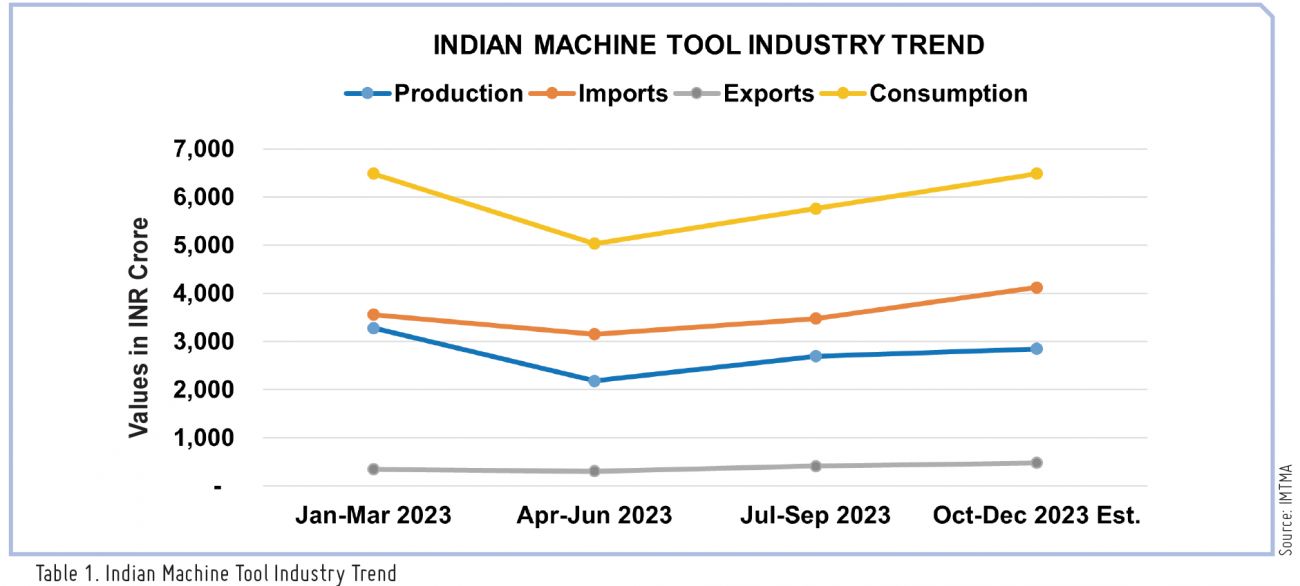

Indian Machine Tool industry production in CY2023 increased by about 9 percent year-on-year, reaching INR 12,520 Cr (US$ 1.5 B). Machine tool exports during CY2023 from India reported an 8 percent growth, amounting to INR 1,543 Cr (US$ 185 M) and consumption is estimated to have increased by 13 percent to reach INR 25,283 Cr (US$ 3 B) in CY2023. |

Fiscal indicators also indicate a positive picture, with the Government of India’s (GoI) Gross Tax Revenue (GTR) showing a growth of 14.4 percent during April-December FY24. Moreover, the FY25 Union Budget projected a reduction in fiscal and revenue deficits for FY24, indicating prudent fiscal management. Despite global economic headwinds, India's merchandise trade deficit reached a nine-month low in January 2024, showcasing improved trade dynamics amidst a challenging global scenario. With promising growth forecasts from international institutions like the IMF, India’s economic growth trajectory continues to inspire confidence both domestically and globally.

Indian machine tools scene

Indian Machine Tool industry production in CY2023 increased by about 9 percent year-on-year, reaching INR 12,520 Cr (US$ 1.5 B). The industry’s imports in CY2023 saw a rise of 16 percent year-on-year, amounting to INR 14,305 Cr (US$ 1.7 B). Machine tool exports during CY2023 from India reported an 8 percent growth, amounting to INR 1,543 Cr (US$ 185 M) and consumption is estimated to have increased by 13 percent to reach INR 25,283 Cr (US$ 3 B) in CY2023.

In CY2023, China (29%), Japan (21%), and Germany (10%) emerged as the top countries for imports, contributing to 60 percent of the total machine tool imports. Presses (13%), Vertical Machining Centers (VMC) (12%), and Turning Centers (11%) were the top machinery types imported, valued at INR 5,243 Cr (US$ 634 M), constituting approximately 37 percent of total machine tool imports during the period.

While for exports, Russia (27%), the USA (10%), and China (7%) emerged as the top three export destinations, accounting for 44 percent of total machine tool exports in CY2023, with a total export value of INR 679 Cr (US$ 82 M). Turning Centers (17%), VMCs (13%), and Horizontal Machining Centers (11%) were the top three machinery types exported, valued at INR 631 Cr (US$ 76 M), constituting approximately 41 percent of total machine tool exports during CY2023.

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe