AUTOMATION & ROBOTICS: CURRENT & FUTURE OUTLOOK

India’s manufacturing sector is rapidly adopting automation and robotics to enhance productivity, improve quality, and remain globally competitive. This article examines current adoption trends, key challenges, and the strategic roadmap for future growth. The insights presented are based on contributions from NRI’s Nishant Shekhar (Principal), Prabhod Mudlapur (Senior Consultant), and Mohit Agarwal (DSC), along with Ashim Sharma.

India stands at the cusp of a major industrial transformation, and we are targeting an increase in the share of manufacturing in the economy—from approximately 13 percent in 2024 to 25 percent by 2047—as part of our quest to become a developed nation. We also aim to grow our share of global exports to 10 percent. India’s manufacturing output is currently growing at a CAGR of 8 percent, while merchandise exports are increasing at 10 percent. To sustain this growth, achieve our targets, and enhance our competitiveness against global peers, Indian manufacturers must embrace cutting-edge technologies like automation. This adoption is not merely a response to global trends but a proactive step toward fostering innovation, increasing productivity, improving quality, and enhancing worker safety.

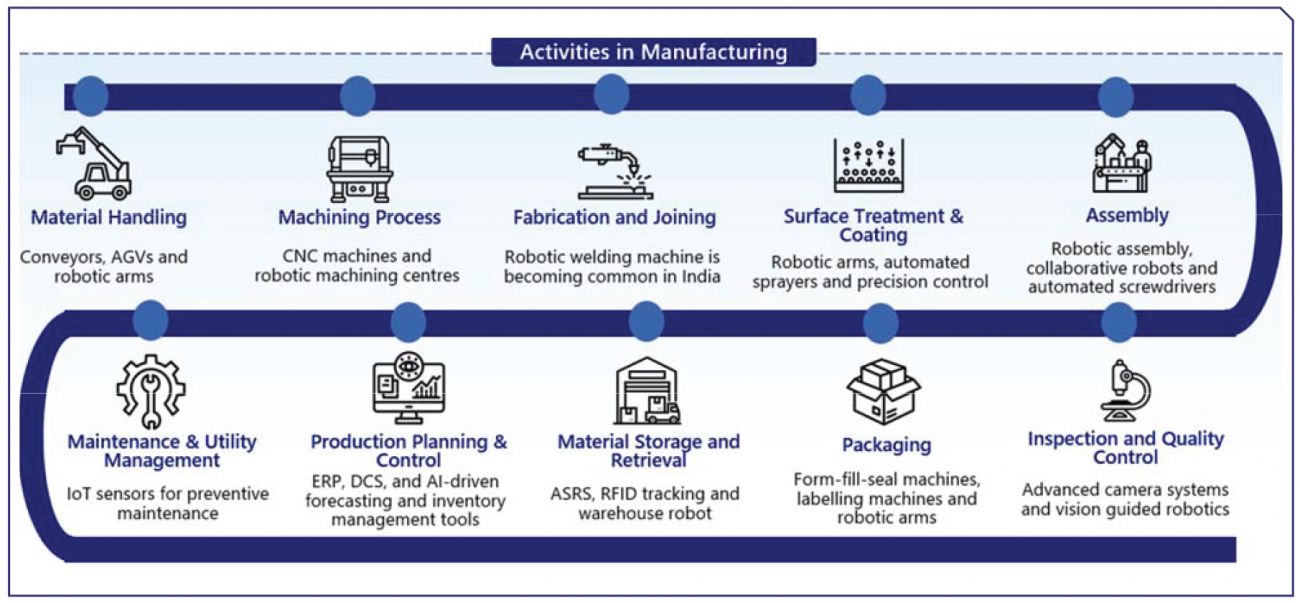

Automation in Manufacturing Activities

The following are key areas within the manufacturing process where automation technologies can be effectively applied.

Material Handling:

Systems like conveyors, AGVs, and robotic arms are used to transport raw materials and components within the facility to improve speed and reduce human effort.

Machining Process:

CNC machines and robotic machining centers are being deployed to perform high-precision tasks such as cutting and drilling.

Fabrication and Joining:

Robotic welding machines are increasingly being used in Indian manufacturing companies to ensure consistent weld quality and speed up the welding process.

Surface Treatment and Coating:

Robotic arms and automated spraying systems are used for coating applications.

Assembly:

Robotic assembly lines, collaborative robots, and automated screwdrivers are used to streamline final assembly processes.

Maintenance and Utility Management:

IoT-enabled sensors can be used for predictive maintenance and real-time monitoring of equipment health.

Production Planning and Control:

Advanced ERP, Distributed Control Systems (DCS), and AI-based forecasting tools enable dynamic production planning and efficient inventory management.

Material Storage and Retrieval:

Automated storage and retrieval systems (ASRS), RFID tracking, and warehouse robots help improve inventory management and warehouse efficiency.

Packaging:

Robotic arms and automated labelling systems ensure speed and consistency in packaging.

Inspection and Quality Control:

Vision-guided robotic systems and advanced camera technologies are used to detect defects and ensure that finished goods meet quality standards.

Current State of Automation in India

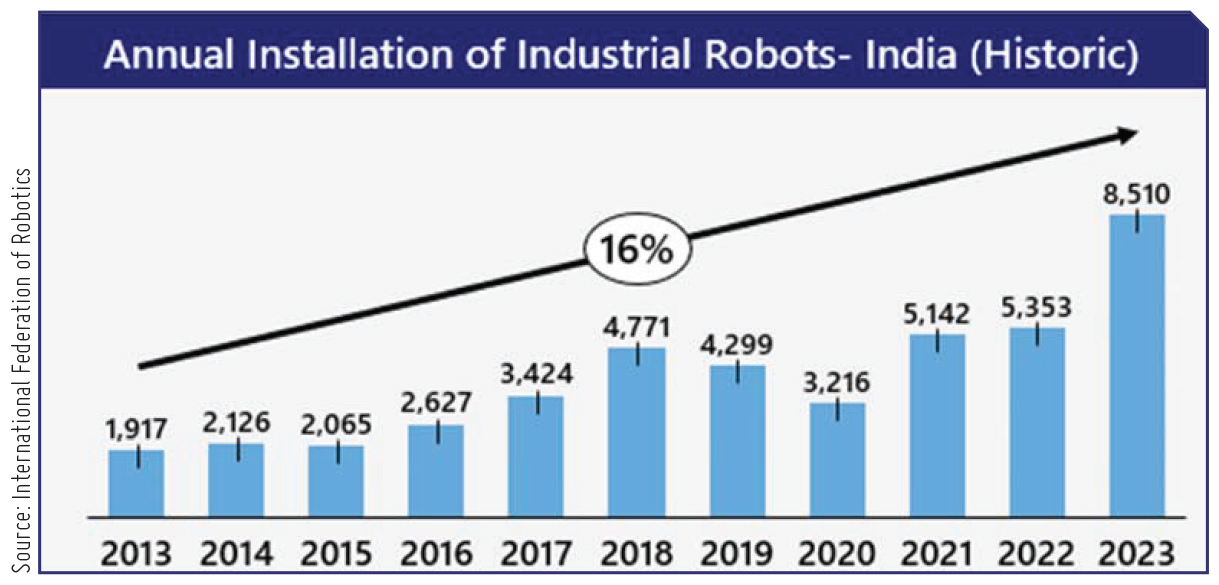

The annual installation of industrial robots in India recorded a CAGR of 16 percent between 2013 and 2023, with 8,510 robots installed in 2023 alone. This growth is expected to continue at a similar rate until 2033, driven by ongoing technological advancements and declining costs in robotics.

India’s industrial automation market is currently valued at approximately US$ 15 billion and is projected to grow at a 12 percent CAGR, reaching around US$ 40 billion by 2033. This expansion is supported by national initiatives such as Digital India and Make in India, along with rapid developments in AI technologies.

To further accelerate the adoption of automation, the Government of India has launched SAMARTH Udyog Bharat 4.0 (Smart Advanced Manufacturing and Rapid Transformation Hub), promoting Industry 4.0 and smart manufacturing. A draft of the National Strategy for Robotics is also under review, prioritizing the use of robots in sectors like Manufacturing, Healthcare, Agriculture, and National Security.

In addition, policy initiatives such as Make in India, the National Manufacturing Policy, and Production-Linked Incentive (PLI) schemes are focused on boosting India’s manufacturing output, thereby encouraging greater adoption of automation technologies across the industry.

Adoption Trends Across Key Industries in India

According to NRI, the scope for automation and robotics spans across several key sectors in Indian manufacturing:

Mobility (Automotive):

Robotic assembly lines can handle repetitive tasks such as screwdriving, windshield installation, and wheel mounting. AI-based vision systems enable inspection and surface quality checks, while collaborative robots (cobots) assist in high-precision tasks like spot welding.

New Energy:

The automation trend will increase with the adoption of robotic solar cleaning modules, PLC based SCADA for controlling solar plant, and smart grids to match the supply and demand of electricity in real time.

Electronics:

Automation in the form of additive manufacturing can produce complex and miniature designs, thereby reducing waste and saving time. Alternatively, cobots can be used to insert chips into testing machines or perform operations like soldering.

White Goods (Home Appliances):

Automated conveyors can be deployed in manufacturing facilities to perform heavy duty tasks. This also prevents collision of material during the movement. Automation of processes like fastening leads to faster cycle time and better torquing in ergonomically unfavorable locations.

Heavy Equipment:

Robotic welding increases speed and precision, thereby reducing defects. Alternatively, robotic assembly can boost the efficiency while minimizing manual errors and rework, especially for large scale repetitive tasks.

Defence & Aerospace:

Automated conveyors can be used to streamline the movement of heavy parts like fuselage sections or missile casing between workstations. Robotic arms can also be used to precisely fill hazardous components like propellants or explosives.

| The annual installation of industrial robots in India recorded a CAGR of 16% between 2013 and 2023, with 8,510 robots installed in 2023 alone. This growth is expected to continue until 2033, due to technological advancements and declining costs in robotics. |

Key Challenges in Automation

Despite the growing importance of automation in global manufacturing, Indian players face challenges in adopting and scaling robotics and automation technology. Following are a few:

Upfront Cost: The cost of adopting automation technology is a major hurdle. Investing in industrial robots, supporting software, and enabling infrastructure requires significant upfront capital and expertise.

Workforce Transition: The transition to automated systems is impeded by a lack of skilled manpower. Many shop-floor workers are unfamiliar with operating or troubleshooting advanced automation systems.

Organizational Resistance: Cultural resistance to change, coupled with fears of job losses, often leads to opposition within organizations.

Inadequate Infrastructure:

There is a lack of supporting infrastructure, including limited cloud computing capacity, low domestic production of key automation components (such as sensors and robots), and gaps in industrial data management.

Complex Integration: Legacy systems often lack the flexibility or tech capacity to interface with advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and cloud platforms.

| To further accelerate the adoption of automation, the Government of India has launched SAMARTH Udyog Bharat 4.0 (Smart Advanced Manufacturing and Rapid Transformation Hub), promoting Industry 4.0 and smart manufacturing. |

Way Forward

To support the adoption of automation in the Indian Manufacturing sector, it is essential to develop a holistic and inclusive strategy that addresses financial, infrastructural, and human capital challenges.

Financial Support: To ease the burden of high upfront automation costs—especially for MSMEs—the government and industry bodies should explore providing capital subsidies and interest waivers on equipment purchases. Reducing import duties on automation technologies can further enhance their accessibility for Indian manufacturers.

Improving Infrastructure: Public-private partnerships can be leveraged to develop manufacturing parks with advanced infrastructure and support services. This can help attract investment in automation and create shared infrastructure for players.

Autonomation (Jidoka): A concept in lean manufacturing which refers to ‘automation with a human touch’. This approach can help reduce job loss concerns while ensuring human oversight in automated processes.

Skill Development: Employees should be upskilled and reskilled through partnerships between industries and institutions, offering vocational trainings and certification programs focused on automation technologies.

Assessing Suitability: Automation should be prioritized in sectors where Indian companies face disadvantages due to limited domestic resources or a shortage of skilled labor. This can help derive a competitive advantage and improve overall efficiency.

|

Ashim Sharma |

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe