MACHINE TOOL INDUSTRY RECORDS 11% GROWTH IN Q1 FY26

India’s manufacturing momentum remains strong despite a mixed economic backdrop. In September 2025, the Manufacturing PMI held firm at 57.7, reflecting healthy factory activity, while inflation eased to record lows, supporting growth. Within this environment, the Indian machine tool industry posted steady expansion in FY26, with production up 11 percent year-on-year to INR 2,615 crore.

The economic indicators for September 2025 showed a mixed trend. The Manufacturing PMI (Purchasing Managers’ Index) stood at 57.7, with an average of 58.7 in the second quarter of FY26, showing strong factory activity. The Services PMI was also high at 60.9 in September, averaging 61.4 in the same quarter, indicating steady growth in the Services sector. However, overall IIP (Index of Industrial Production) growth moderated to 4.0 percent in August 2025 from 4.3 percent in July 2025 due to slower growth in manufacturing output.

Inflation Trends Ease

CPI (Consumer Price Index) inflation fell to 1.5 percent in September 2025, breaching the lower end of the RBI’s target band and marking its lowest level in the 2012 base series, while core CPI inflation rose to a 25-month high of 4.7 percent. Meanwhile, WPI (Wholesale Price Index) inflation eased to 0.1 percent in September 2025 from 0.5 percent in August 2025, mainly due to a decline in food prices and a slower rise in non-food articles.

Fiscal and Revenue Indicators

The Government of India’s (GoI) gross tax revenues (GTR) grew by 0.8 percent during April–August FY26, reflecting a 1.0 percent contraction in direct taxes and a 2.9 percent growth in indirect taxes. GoI’s total expenditure rose by 13.8 percent during the same period, driven by a 7.2 percent increase in revenue expenditure and a 43.4 percent rise in capital expenditure.

The fiscal and revenue deficits stood at 38.1 percent and 37.9 percent, respectively, of their annual budget estimates for FY26.

Stable Credit Growth

In the Financial sector, gross bank credit growth remained stable at 10.0 percent in both July and August 2025, indicating steady credit demand in the economy. In the external sector, net FDI turned negative in August 2025, with outflows of US$ 0.6 billion, while net FPI (Foreign Portfolio Investment) also recorded outflows of US$ 2.6 billion for the second consecutive month, reflecting weaker foreign investment.

Trade Deficit Widens

|

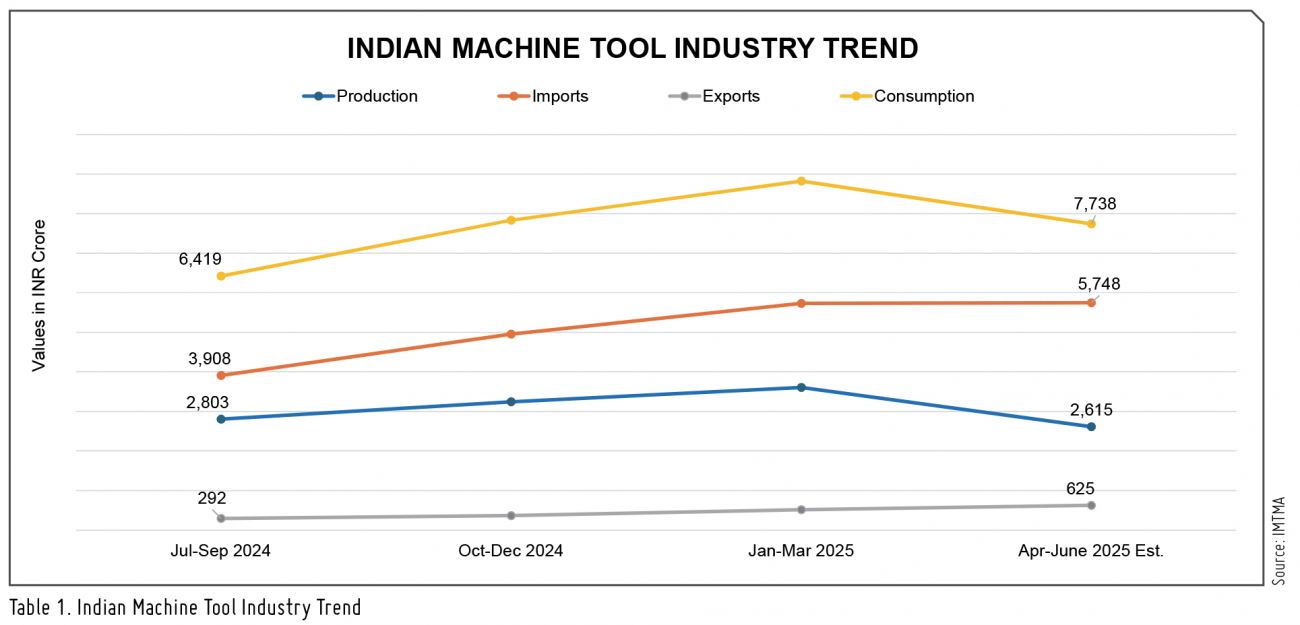

In Q1 FY26, exports soared 108% to INR 625 crore. Imports rose 40%, led by machines from China, Japan, and Germany, while domestic consumption climbed 26 percent to INR 7,738 crore. Presses and machining centers remained the most traded products. |

The merchandise trade deficit widened to a 13-month high of US$ 32.1 billion in September 2025, up from US$ 26.5 billion in August 2025, mainly due to an increase in the non-oil trade deficit. Merchandise exports recorded moderate growth of 6.8 percent, while imports grew by 16.7 percent, reversing from a (-)10.1 percent decline in August 2025, driven largely by a surge in gold imports. Meanwhile, global crude oil prices fell to a fourmonth low of US$ 66.5 per barrel in September 2025, following expectations of a rise in OPEC+ output from November 2025.

Global and Domestic Growth Outlook

The OECD (Organisation for Economic Co-operation and Development) projected global growth at 3.2 percent in 2025 and 2.9 percent in 2026, while India’s growth is expected to remain strong at 6.7 percent in FY26 and 6.2 percent in FY27.

Machine Tool Industry Registers 11% Growth

The production of the Indian Machine Tool industry in Q1 FY26 is estimated to have increased by approximately 11 percent year-on-year, reaching around INR 2,615 crore (US$ 306 million). The industry’s imports in Q1 FY26 saw a rise of 40 percent year-on-year, amounting to INR 5,748 crore (US$ 672 M). Machine tool exports from India reported a growth of 108 percent, amounting to INR 625 crore (US$ 73 M) and consumption was estimated to have increased by about 26 percent to reach INR 7,738 crore (US$ 904 M).

Import and Export Composition

The total machine tool imports in April to September 2025 (H1 FY26) was INR 11,464 crore (US$ 1,326 M) China (28%), Japan (22%), and Germany (13%) emerged as the top countries for imports, contributing 63 percent of the total machine tool imports in April to September 2025 (H1 FY26). Presses, Vertical Machining Centers (VMCs) and Horizontal Machining Centers (HMCs) were the top categories of machinery imported valued at INR 4,574 crore (US$ 530 M) at about 38 percent of total machine tool imports in H1 FY26.

For exports, VMCs, Presses, and HMCs were the top three categories of machinery exported valued at INR 749 crore (US$ 86 M) at about 53 percent of total machine tool exports in H1 FY26. The total machine tool exports in April to September 2025 (H1 FY26) was worth INR 1,426 crore (US$ 165 M).

Source: Data & Policy Team, IMTMA

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe