Leveraging Industry 4.0 through Smart Finance

While Industry 4.0 machines, technology and equipment are revolutionizing manufacturing by digitalizing production processes, quality assurance, maintenance, and many other aspects of the manufacturing ecosystem, there are challenges revolving around its adoption that can be overcome with finance.

Momentum for Industry 4.0 transformation is well under way across the globe. Industry 4.0 initiatives are expected to generate $21.7 billion annually in technology investment by 2023, having grown at a compound annual growth rate (CAGR) of 23.1 percent since 20171. In terms of specific technology types, cyber-physical systems are expected to achieve the highest CAGR of 26.7 percent, reaching a total market value of $4.8 billion in 2023.

At its core, Industry 4.0 is based on a set of design principles that link people, systems, places and equipment/technology – interoperability, information transparency, technical assistance and decentralized decisions. It is essentially a practical means of seamlessly integrating physical machinery, robotics, information technology and the internet in ‘smart’ factories. Leading investors in Industry 4.0 can be found in all global industry sectors, and several research commentators predict that the Asia-Pacific region, especially China, will retain the greatest market share through the early 2020.

Not 'whether' but 'when'

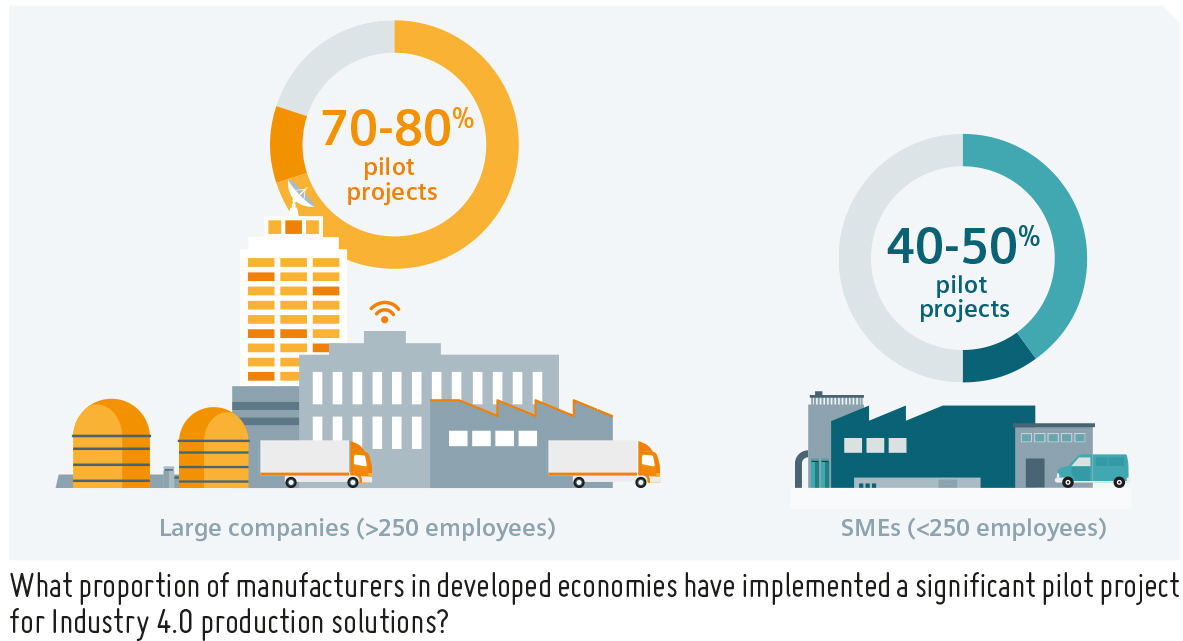

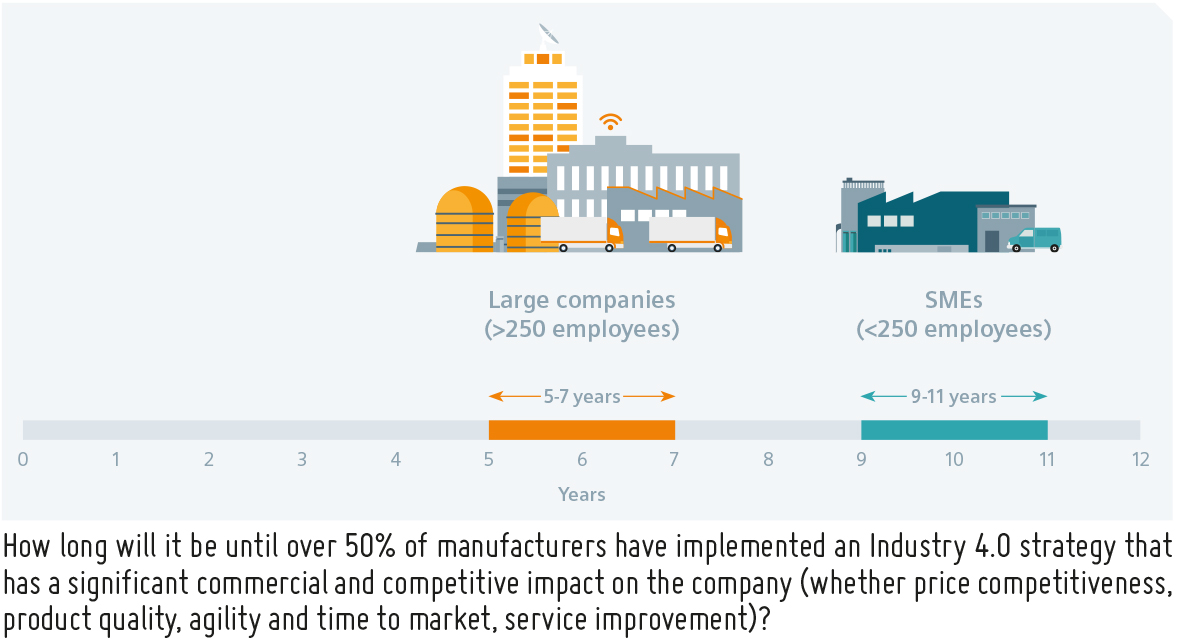

The question hanging over digital transformation in manufacturing is no longer ‘whether’ to invest in it but rather ‘when’ to do so. In most marketplaces, the early mover will invest in new technologies or business models to gain a competitive advantage – at the expense of competitors that have not adopted. For the ‘laggard’ half of the market, investment in the new technologies or models is still required, but the possibility to gain competitive advantage has disappeared, upgrading as a ‘follower’ simply entails aligning with the new market norm.

Smart CEOs and CFOs in manufacturing are therefore recognizing the importance of being in the earlier swathe of adopters to get ahead of the competition. The market is fast approaching the tipping point, when the majority of the market will have adopted the new technology and business model. This deadline is made even more urgent by the realization that these ‘laggard’ adopters likely won’t erode the gains made by earlier adopters for some period of time, if at all.

The size of the prize

Each manufacturing sector, even down to the individual manufacturer, needs to carefully analyze their particular situation to identify a clearly articulated and evidence-based business case for return on investment. While estimated returns are based on models or forecasts, smart manufacturing CFOs manage risk by introducing sensitive monitoring processes and methods to closely track progress toward projected goals and gains.

Nevertheless, return on investment is predicted to be very substantial. One major analyst, for instance, predicts that by 2020, manufacturers worldwide will be saving $421 billion annually as a result of Industry 4.0 investments and will gain $423 billion per year in revenues each year as a result of digital transformation.5 In addition, previous research papers from Siemens Financial Services (SFS)6 have presented evidence-based estimates of the financial benefit that manufacturers stand to gain from upgrading their production environment to Industry 4.0.

Overcoming Industry 4.0 challenges with finance

Ultimately, while there is momentum behind the transition to Industry 4.0, many commentators have remarked that the pace of transformation could stand to accelerate, especially as incumbent players look to compete with rival economies, stay ahead of new entrants, and manage disruptive change. Clearly there are challenges for Industry 4.0 adoption. The World Economic Forum summarizes these challenges as:

- difficulty in aligning the organization around the potential value and return on investment,

- uncertainty surrounding digital’s value to their performance (especially in the short term),

- the cost of resources needed to implement new solutions, and

- the investments required to take them to scale.

These challenges tend to pivot around the issue of finance. The organization needs to understand the commercial benefits of Industry 4.0 and be confident that there will be a reliable return-on-investment. Then, it needs to be able to pay for the corresponding technology at a rate less than or equal to commercial gains in order to make the investment sustainable and cash-flow friendly. In response to these conditions, the term ‘Finance 4.0’ has been coined to describe financing techniques that enable sustainable digital transformation.

Industry 4.0 initiatives are expected to generate $21.7 billion annually in technology investment by 2023, having grown at a compound annual growth rate (CAGR) of 23.1 percent since 2017.

Finance 4.0 is the answer

This paper sets out the potential spectrum of smart financing options available to manufacturers.

Technology Upgrade and Update : For manufacturers already well on the path to becoming a fully digital enterprise, integrated equipment and technology finance options allow them to upgrade during the financing period and offer protection against technological obsolescence. Upgrades might involve replacing with a newer model or retro-fitting enhancements onto the main technology platform. Ultimately, manufacturers can use the additional flexibility to roll out Industry 4.0 and grow at the same fast pace as the accelerating demand for their (improved) products.

Pay to Access / Use Equipment & Technology Finance : Early engagement with the right financing partner will enable manufacturers to size and specify the pilot without unnecessary financial constraints and help build the business case with the freedom to access the technology that best fits their needs. Financial solutions will usually be based on a range of options : finance lease, operating lease, rental or hire purchase arrangement. Financiers with a deep knowledge of manufacturing in general and digitalization in particular will adapt the finance arrangement to align with the likely benefits the manufacturer will gain from the technology. This type of financing can also cover associated costs of ownership, such as maintenance, into a ‘bundled’ monthly payment. To enable a series of implementation and adoption decisions over time, financiers can also put in place an enterprise-enablement ‘master’ agreement with a manufacturer. This is an umbrella arrangement that speeds up new technology and gives the manufacturer the confidence that they will be able to acquire new technology from an OEM as soon as they need it.

Software Finance : The journey to digital transformation requires deploying combined hardware and software solutions that can deliver digital data streams of performance data. These data are the key to production optimization, predictive and remote maintenance, and more intelligent manufacturing. This is recognized by specialist financiers that can offer manufacturers integrated arrangements for financing requirements.

Pay for Outcomes : Financing agreements in which payments are predicated on the expected business benefits, or ‘outcomes’, that the technology makes possible are being offered with increasing frequency. Savings or gains from access to the technology are used to fund monthly payments, making the technology cost-neutral for the manufacturer.

Finance to Assist Transition from Pilot to Mainstream

While the benefits of moving to a digitalized manufacturing environment are clear, the process of transition has to be carefully managed and commercial risk eliminated by rigorously testing new technology in the real-world production environment. This can often act as a barrier to digital transformation because the manufacturer is discouraged by the idea of having to pay for both the old or pilot arrangement and the new or scaled approach during the transition period. Recognizing the challenges of transition, financing arrangements are available that defer payment for a new system or scaled setup until it is reliably up and running. This removes the financial challenge of having to pay for the new system while the old one is still running.

Working Capital Solutions : As the competitive advantage from Industry 4.0 generates growth, manufacturers are under increasing pressure to manage cash flow. Cash flow and working capital challenges arise at moments other than just the initial point of acquiring digitalized technology. Digitalization may increase production capacity and productivity, while improving price competitiveness, to the extent that a manufacturer’s order book experiences a sudden, significant upswing. This is good news. Yet the momentum that is built through digitalization brings its own challenges – such as suddenly having to buy raw materials or components in greater quantities. Added-value financing services offered in partnership with a specialist financier – usually based on some form of invoice finance – are available to help manage the cashflow challenges brought on by success through digitalization.

Finance Solutions to Enable OEM Sales Momentum : OEMs have access to the full range of Industry 4.0 finance techniques, with one important addition. Vendor financing programs can offer OEMs further competitive advantage, as they drive their own businesses or enable their own customers to become digital enterprises. OEMs and systems integrators can partner with digital finance specialists to offer integrated finance to their own prospective and existing customers – be the large, medium or small manufacturers – so that they can acquire new machines and digital solutions.

Vendor finance can help OEMs, systems integrators and other technology vendors to enhance their value proposition and overcome competitive pressures by providing an alternative to outright purchase during the initial scoping and needs analysis phase. Vendor finance can play an important, complementary role to support the sale of digital technology and machines and can encompass complete finance solutions, including maintenance, servicing, hardware and software. With affordable payment options, this can also help the OEM’s customer to consider a more tailored technical specification and overall solution to fit the customers’ needs over time.

As the competitive advantage from Industry 4.0 generates growth, manufacturers are under increasing pressure to manage cash flow.

.jpg)

SUNIL KAPOOR

CEO

Siemens Financial Services

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe