Blockchain : Empowering Manufacturing Sector

Blockchain has the potential to revolutionize how manufacturers design, engineer, make, and scale their products. It’s enabling a future with greater trust, streamlined operations, transformed pricing models and safer reputations.

Source: PricewaterhouseCoopers

In PwC’s recent Global Blockchain Survey, 84 percent of executives across industries said their companies have had some involvement with blockchain, and 15 percent have live projects. It’s easy to see what’s driving that enthusiasm - the potential for blockchain-powered solutions to create value by helping firms to overcome challenging problems is clear. Implemented well, blockchain can increase transparency throughout supply chains, track the identity and credentials of key personnel, allow for more seamless audit and compliance functionality, and more. And industrial manufacturing companies are already seen as being out front in developing the technology — respondents in our survey ranked the sector second (tied with the energy sector and trailing only financial services) among industries leading the way on blockchain.

Blockchain basics

Few recent technological developments have created more buzz than blockchain. Perhaps even fewer are less understood.

A blockchain is a distributed ledger of transactions—rather than being kept in a single, centralized location, it’s held by all the users in a network. In general, all these users, also known as network nodes, have copies of the same ledger. Transactions on a blockchain don’t have to be financial—they simply represent a change in state for whichever data point the blockchain’s stakeholders want to track.

Blockchains are driven by consensus. When a user initiates a transaction, its details are broadcast to the entire network, checked by other users and accepted if there is consensus. Once a transaction has been validated, it’s bundled with other transactions into a block of data.

Each block is secured via a cryptographic algorithm. This results in a unique signature for each block known as a hash. These blocks are then ordered sequentially into a chain of blocks, with each block also containing the previous block’s hash. This makes it extremely difficult to tamper with a block, as altering a single piece of data would result in a different hash value, making it evident to the blockchain’s users and causing the transaction to be rejected.

Some parts of this process can be done automatically with smart contracts. These involve two entities turning a business contract into code that recognizes actions on the blockchain. For example, a smart contract might recognize that a sale of an asset by ‘Company A’ to ‘Company B’ on a certain date should be for a specific price. This simplifies processes that take significant time to check.

This structure gives network participants confidence in their transaction without the need to trust each other. Nor do they need to agree on a trusted third party to make sure they’re both following the rules. Because the ledger of transactions is consensus-based and distributed, records stored in it cannot be erased or changed.

Blockchain’s industrial impact

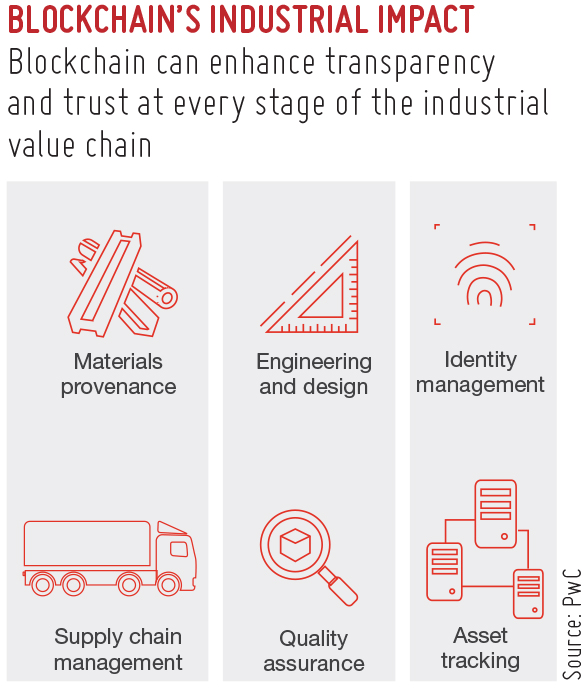

Blockchain is being explored to offer solutions to long-standing industry pain points including :

- Supply-chain monitoring for greater transparency into complex, cross-constituency supply chains where delays and sourcing constraints impact production and profitability;

- Materials provenance and counterfeit detection to reduce the $4.2 trillion impact of counterfeiting and piracy on the global economy by 2022, as cited by World Trademark Review;

- Engineering design for long-duration, high-complexity products, for which delays in sharing updated engineering specifications or parts supersessions can increase rework and delay final delivery (e.g., aircraft);

- Identity management for when it is important to know who is taking an action and what their credentials are, including attorneys, auditors, engineers and technicians;

- Asset tracking to monitor complex and expensive equipment movements or intermodal logistics across carriers;

- Quality assurance that can look across a production life cycle to gauge qualifications, quality, patterns of defects, etc.;

- Regulatory compliance enhanced by indelible records of actions taken, assets’ movements evidenced by permissioned consensus — available in seconds.

Blockchain-powered solutions can seamlessly aggregate all of this information, delivering significant value for industrial companies, and can also help unlock the full potential of other advanced technologies like augmented reality, IoT and 3D printing.

Some use cases

Following are a few examples of industrial blockchain use cases.

A typical single-aisle commercial jet is made up of 300,000-plus parts, while a superjumbo can comprise more than 2 million parts. Even amid advances in sensor technology, connected devices, data analytics and cloud computing, there’s still a lack of transparency (or real-time access) to information about which parts are on which planes (and in which configuration), when they were last serviced and by whom. In fact, getting a holistic, real-time picture across an entire fleet of aircraft — regardless of who might need that information (e.g., an airframer, the airline, or a key supplier) — is all but impossible.

Blockchain technology could provide the solution. It has the power to foster trust among parties who may be competitors in the marketplace but must cooperate within the common ecosystem of the airplane by balancing transparency and privacy on a distributed ledger. Not only can blockchain track the provenance of individual components, but by giving a snapshot of all the parts on a plane, it also has the ability to seamlessly record its configuration for every flight of its 30-year operating life.

The key is blockchain’s ability to generate a digital birth certificate for very part that’s installed in a plane and update it every time it’s serviced or inspected by a technician. The data collected could include the aircraft’s tail number, the part’s location (GPS and/or slot location on the aircraft), the manufacturer, the permissibility of the part (e.g., supersession, ‘red tag’ status, etc.), the identity of each technician with whom the part has interacted as well as the location in which the service was performed.

And a blockchain-powered solution can give the right stakeholders a view of that part from birth certificate to current day, while withholding data from others to avoid revealing proprietary information or trade secrets. For example, an airframe manufacturer or airline implementing such a solution might be able to see the condition, usage, installer and manufacturer of all parts on each of its planes, while a parts manufacturer could only see aircraft in which its products are installed, but not those installed with a competitor’s product. Nonetheless, even this level of visibility would give unprecedented clarity into its true market share.

Gains that can ensue

Substantial blockchain-driven gains in efficiency and safety are possible:

- Increase asset utilization.A real-time, continuously updated ledger of each part’s condition and usage could help reduce time spent on routine inspection and maintenance of aircraft. It can also reduce airlines’ needed inventory of spares.

- Improve the aftermarket value of planes. Jet engines maintained to the standards of their manufacturer and which include only verified authentic parts fetch premium prices on the secondary market. Such verifiability offered via blockchain could likewise boost the resale value of used aircraft.

- Reduce the cost of flight safety. An operator (passenger or cargo) will not use a part that is not trusted. The cost of a part with no provenance can be as little as the inventory carrying cost of that part until its history is known or as much as an aircraft on the ground for want of a part which is available, but not trusted. Knowing the history of a part in the moment in which you interact with it has the potential to significantly reduce the impact of ensuring safe flight.

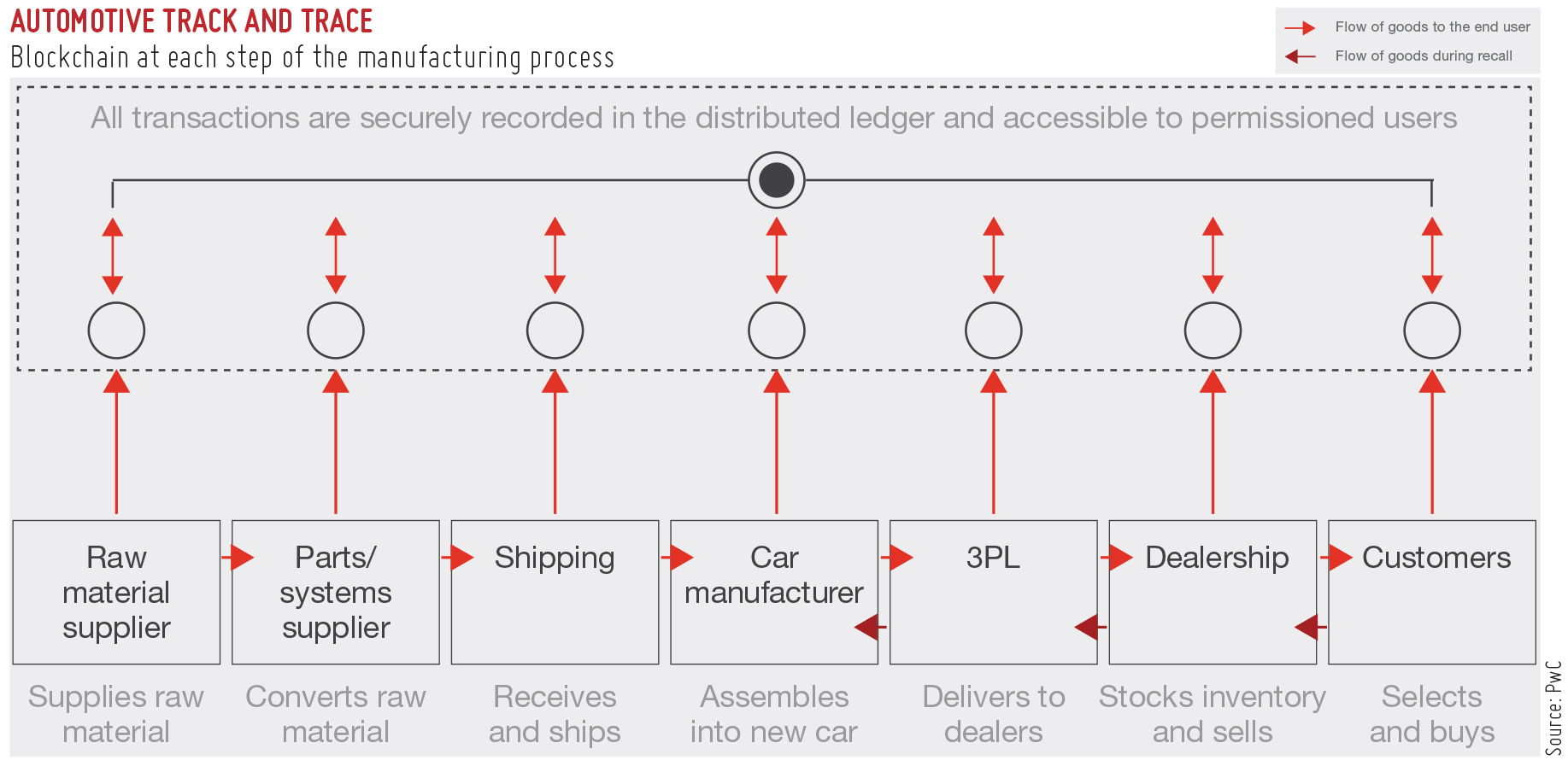

Raw materials are fashioned into individual components, which are assembled into larger systems that are ultimately assembled as automobiles. But, while auto manufacturers are ultimately accountable to customers and regulators for their vehicles’ reliability and safety, they can lack sufficient visibility into the provenance of the vehicles’ parts and their journey from the mine to the showroom floor.

A blockchain-enabled solution would help automakers to track every step of that journey into all supply chain tiers. And, if a component is defective, it could help them determine the cause, whether it be poor-quality steel, the work of one of their suppliers, or an issue in their own plant. When combined with connected sensors and other Internet of Things (IoT) technology, a blockchain-powered system could even record the conditions a shipment of components faced aboard a train or container ship. That would provide a clue that rough seas or poorly controlled temperatures could have caused damage.

Because the companies that make up an automotive supply chain form an interdependent web, it could be beneficial for all stakeholders to have some visibility into the disposition of products. That can be difficult when the information is stored in multiple, incompatible systems.

Additional ways blockchain can help automakers manage their supply chains include:

- Improve recall response.Identifying which cars have components subject to a recall can be a time-consuming and resource-intensive task; the data is typically stored across multiple systems and requires reconciliation for accuracy to track products. By leveraging blockchain, vehicles with defective parts can be quickly and seamlessly identified—perhaps even before they’ve left the plant. And the faulty part’s journey from the supplier’s factory through final assembly can be traced.

- Strengthen inventory management. A blockchain-powered solution can help automakers and their suppliers track bottlenecks in real time throughout the supply chain and enable better inventory planning.

Best practices for blockchain solutions

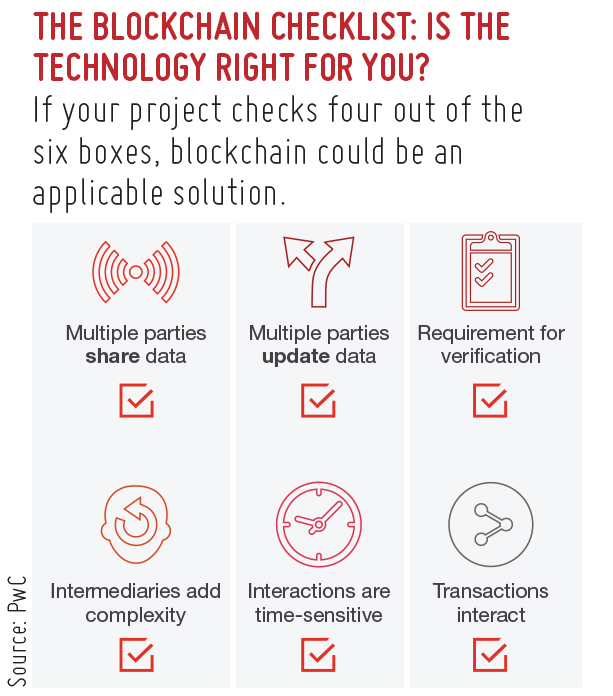

Blockchain solutions can create value for industrial companies in a number of ways. But that doesn’t mean it’s an equally tenable solution for all companies and even industrial manufacturing sectors.

By focusing on four key areas early in their blockchain efforts, companies can set themselves on a path toward successful execution.

Make the business case: Commit to new ways of working, frame the problem and the solution, and start small, then scale out.

To be sure, blockchain can be a powerful tool — but it’s not a cure-all. It’s important to make sure it’s a strategic fit. When there’s a need for different parties to share and update data, when time is of the essence and trust between parties is needed but intermediaries add too much complexity, then blockchain-based solutions can be very effective. But if none or only one or two of those types of challenges are present, then other solutions may be better placed.

It’s also crucial not to assume that a blockchain solution will be able to ‘change the world’ for a company or industry right from the start. It very well might, but the reality is that progress is slow going. Our survey findings reflect this mentality, across industries: Of the respondents to PwC’s Global Blockchain Survey who reported a blockchain project in the pilot stage, 54 percent said the effort sometimes or often hasn’t justified the result. Starting small and experimenting with just a piece of the process that could ultimately be shifted onto a blockchain-based solution can help avoid frustration.

Build an ecosystem: Focus on a cooperative few, broaden your network, and work across the value chain.

Bringing together a group of stakeholders to collectively agree on a set of standards that will define the business model is perhaps the biggest challenge in blockchain. Participants have to decide the rules for participation, how to ensure that costs and benefits are fairly shared, what risk and control framework can be used to address the shared architecture, and what governance mechanisms are in place, including continuous auditing and validation, to ensure that the blockchain functions as designed.

There’s more than one way to make these decisions. In a sponsor-led model, one company ‘owns’ the blockchain and can determine costs, benefits and buildout considerations, charge services to other participants in the network, and set standards that all participants in the ecosystem have to live by. This model works best for very large players that can effectively ‘make the market’. A consortium-based model provides an alternative, allowing companies to be co-owners and -operators, sharing responsibility for costs, benefits, and buildout and standards amongst a group of participants. Serving as an industry consortium founder can be an effective way to guide and shape those decisions without bearing all the risk and responsibility.

Regardless of which model is used, it’s still wise to start small. A manufacturer and a few suppliers and distributors can set blockchain solutions rules and parameters with a clear view of how participants at every level of the value chain can benefit, before determining how to grow the ecosystem in a mutually beneficial way.

Design deliberately: Confront risks early, consider privacy applications, and invest in data and processes

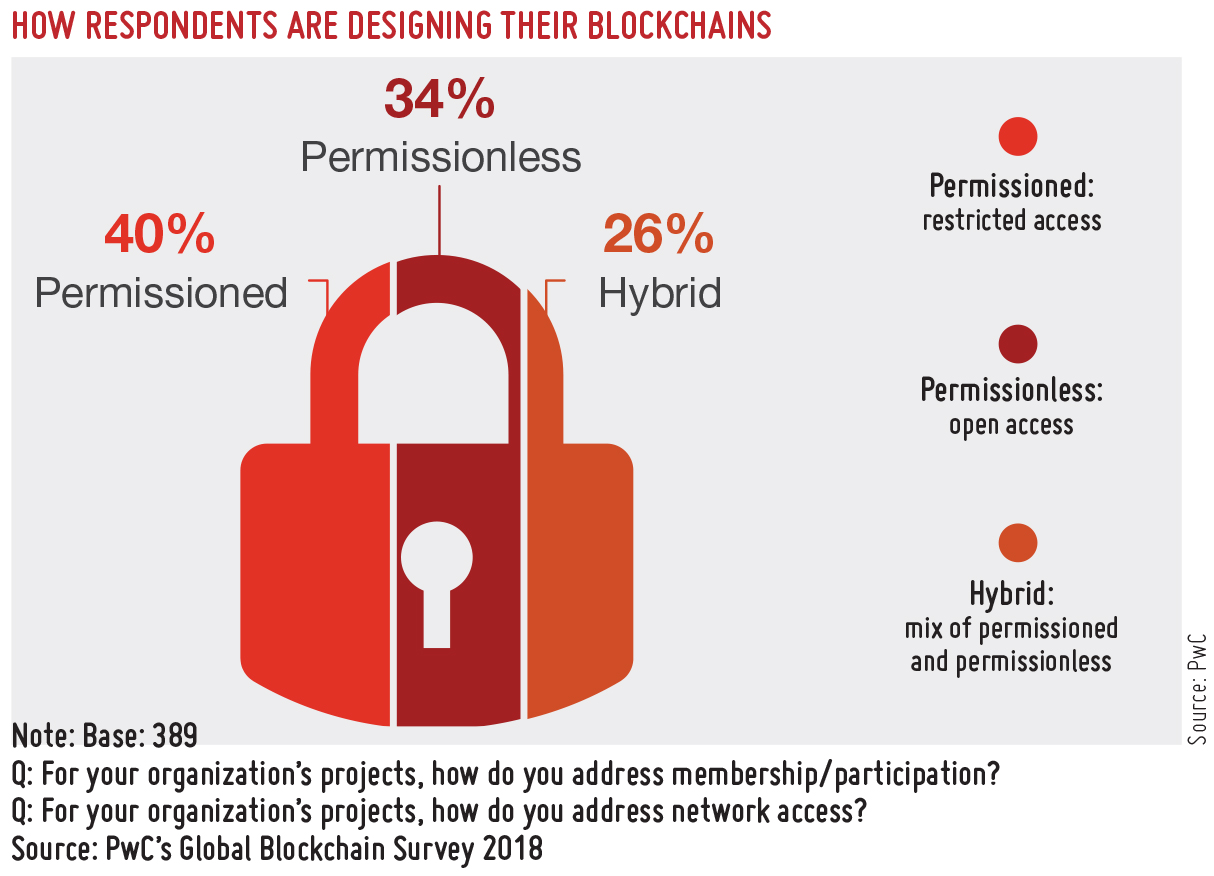

Much consideration must be given to a blockchain’s design. Will it be permissionless, allowing anyone to initiate and view transactions, or permissioned, restricting access to certain parties? Though PwC’s Global Blockchain Survey shows companies are adopting both of these approaches as well as developing hybrid implementations, permissioned blockchains are likely more appropriate for most enterprise solutions, since their owners or governing bodies can structure its rules with an eye to privacy and data security.

No matter which model is chosen, it’s important to include cybersecurity, compliance, audit and legal specialists in important design decisions from the beginning. That will help avoid costly missteps and build trust among all members of the ecosystem.

Navigate regulatory uncertainty: Shape the trusted tech decision, monitor evolving regulation, and use existing regulation as a guide.

Regulators around the world are still evaluating potential responses to the increasing prevalence of blockchain-enabled solutions. And concerns about what those responses will look like remain central to firms considering the technology: Among our survey respondents, 27 percent in total and 26 percent in the US believe that regulatory concerns are the number one barrier to blockchain adoption.

Rather than waiting for regulators to set the blockchain agenda, companies that see value in the technology should be proactive. It’s important to engage with regulators, elected officials and industry groups to make the case that blockchain technology can be trusted.

Remember, too, that blockchain’s potential for transparency, as well as the immutable record it creates, could make it a powerful tool for regulators. The enhanced transparency it gives a business into its operations can serve regulators in the same way. That also gives it the potential to significantly ease companies’ compliance burdens.

Facebook

Facebook.png) Twitter

Twitter Linkedin

Linkedin Subscribe

Subscribe